In most cash sales, both the buyer and seller split the closing costs, though who pays what can be negotiated. Cash offers eliminate lender fees, but there are still expenses like title insurance, escrow, and recording fees. If you’re selling a house for cash, understanding which costs you’re responsible for can help you avoid delays, reduce out-of-pocket expenses, and walk away with more money. This guide breaks down exactly what each party typically pays and how working with a professional cash buyer can simplify the process.

Understanding Closing Costs in a Cash Transaction

Closing costs still apply in a cash sale, even when no mortgage is involved. These fees cover the services needed to transfer ownership from seller to buyer. Here’s what to expect:

What Are Closing Costs When There’s No Mortgage?

Even without a lender, closing costs typically range from 1% to 3% of the home’s purchase price. These fees are paid at settlement and can include:

- Title insurance (protects against ownership disputes)

- Escrow services (handles fund transfers and paperwork)

- Recording fees (to file the deed with the county)

- Attorney or settlement agent fees

- Outstanding taxes or HOA dues

Because there’s no loan involved, buyers avoid lender-related fees like origination charges or appraisal costs.

Do Cash Buyers Always Pay Less in Closing Fees?

Yes, cash buyers usually pay fewer fees than those using financing. Here’s why:

- No loan origination or underwriting fees

- No lender-required appraisal

- Fewer document prep costs

However, cash buyers still pay their share of title-related, legal, and recording fees, which can add up without proper planning.

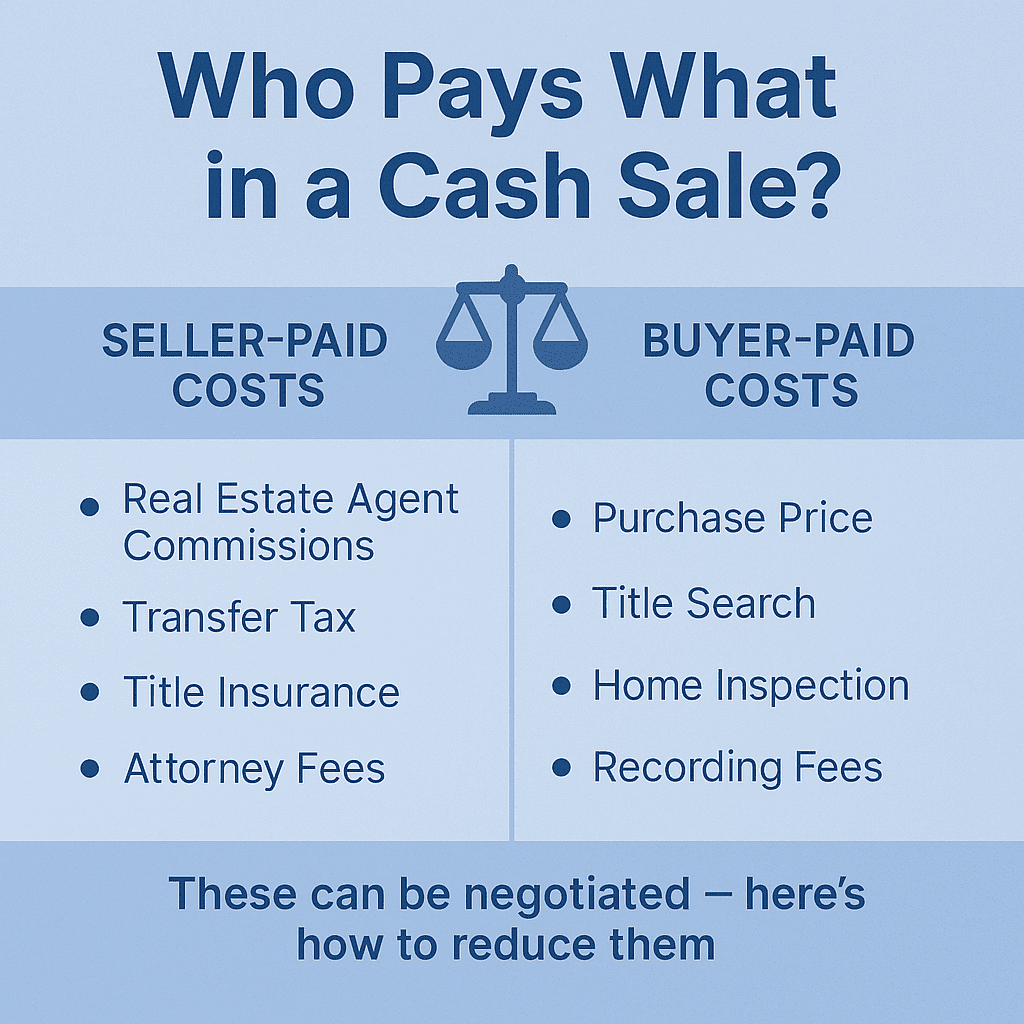

Who Typically Pays What?

In a typical cash sale, the seller and buyer each cover different parts of the closing costs, but these responsibilities can be adjusted depending on the deal. Knowing who pays what helps you prepare financially and avoid surprises at closing.

Standard Seller-Paid Costs

Sellers usually cover the following closing expenses:

- Title insurance for the buyer (in many states)

- Escrow or settlement fees (often split, but sometimes paid by the seller)

- Outstanding property taxes or HOA dues

- Transfer taxes or recording fees (varies by location)

These costs can range from a few hundred to a few thousand dollars, depending on the home’s value and location.

Common Buyer-Paid Costs

Cash buyers often pay for:

- Title search and exam fees

- Recording fees for the deed

- Any inspections they request

- Attorney or closing agent fees (if required by the state)

Since there’s no lender involved, the buyer avoids many traditional costs but still needs to budget for these essentials.

Can Closing Costs Be Negotiated?

Yes, closing costs in a cash sale are often negotiable. In competitive markets, sellers may agree to cover more fees to close quickly. On the other hand, motivated buyers might offer to pay all costs in exchange for a lower purchase price or faster closing.

Negotiating who pays what can save you thousands. That’s why it’s critical to understand your options before agreeing to terms.

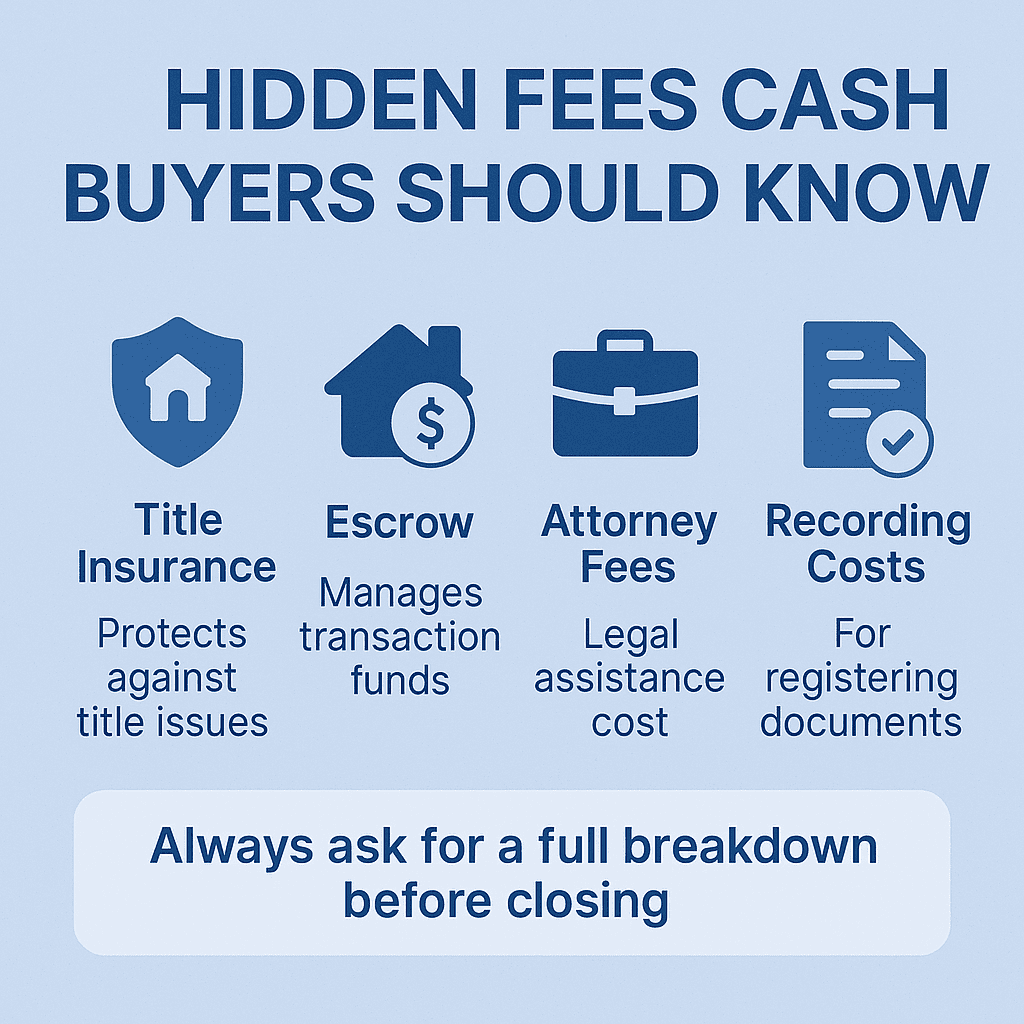

Hidden Fees Cash Buyers Should Watch For

Even in a cash deal, some closing costs can catch buyers off guard if they’re not prepared. These “hidden” fees don’t come from lenders, but from the legal, title, and transfer process.

Title Insurance and Escrow

Yes, cash buyers often pay for their own title insurance, unless otherwise negotiated. This protects the buyer in case someone else claims ownership of the property later. It’s a one-time fee, usually based on the purchase price.

Escrow or settlement agents also charge a fee to:

- Coordinate document signing

- Handle money transfers

- Ensure all paperwork is correct

These fees are often split between buyer and seller, but sometimes the full cost falls to the buyer.

Recording and Transfer Fees

Buyers must often pay a county recording fee to officially transfer the deed. This ensures the transaction is recognized by the local government.

Depending on your location, transfer taxes might also apply. In some areas, the seller pays these; in others, it’s shared or falls entirely on the buyer.

Attorney and Settlement Costs

In states where real estate closings require legal oversight, buyers are responsible for their attorney’s fees. Even in non-attorney states, buyers may choose to hire one for peace of mind.

Expect to pay for:

- Legal review of the purchase agreement

- Guidance on closing documents

- Handling complex title issues if they arise

These professional services are optional but highly recommended for protecting your investment.

How Sellers Can Reduce Out-of-Pocket Costs

Sellers can reduce or eliminate many of their closing costs by negotiating strategically and choosing the right buyer. If you’re looking to keep more cash at closing, here’s how to do it.

Work With Buyers Willing to Cover More Fees

In a hot market or if your property is priced competitively, some cash buyers may agree to cover all closing costs. This can save you:

- Title insurance expenses

- Escrow and attorney fees

- Transfer taxes

Always confirm who’s covering what in the purchase agreement before accepting an offer.

Skip Repairs and Sell As-Is

Selling your house as-is means you don’t have to spend money on repairs or cleaning. This not only speeds up the process but can significantly lower your selling costs.

Cash buyers like 48Acquisitions purchase homes in any condition, so you keep more in your pocket by avoiding prep expenses like paint and cosmetic touch-ups, landscaping, and inspection-related fixes.

Choose a Cash Buyer That Covers Most Costs

Many professional home buyers, including 48Acquisitions, cover most or all closing costs for the seller. This includes, title and escrow fees, transfer taxes, miscellaneous admin costs.

When comparing offers, look beyond the price and consider the full cost breakdown. The right buyer helps you net more at closing, not just sell fast.

How 48Acquisitions Simplifies the Process

48Acquisitions makes cash sales faster, simpler, and more affordable by covering most of the closing costs and removing the usual stress from selling a home.

No Fees, No Commissions, No Surprises

At 48Acquisitions, we eliminate the common costs and frustrations that come with selling a home the traditional way. You won’t pay agent commissions, repair bills, or any out-of-pocket fees. There’s no need to list your home, stage it, or wait on endless showings. We make an honest cash offer, and what we offer is what you get. No unexpected deductions or last-minute changes, just a straightforward process you can trust.

Transparent Offers That Include Our Costs

Every offer we make is easy to understand and fully transparent. We include most closing costs in our offer, including title insurance, escrow, and administrative fees. You’ll always know what’s covered and what you’re taking home. There’s no pressure and no fine print. Our goal is to give you peace of mind and a clear path to selling your home with confidence.

You Walk Away With More Cash, Faster

We close on your timeline, often in as little as seven days. Whether you need to move quickly or want more time to prepare, we work around your schedule. With no agent fees, fewer delays, and no repair requirements, You may walk away with more of your equity, depending on your home’s condition and the negotiated terms. We make sure the process is smooth, respectful, and built around your needs, so you can move forward without stress.

Frequently Asked Questions About Cash Sale Closing Costs

Do buyers really save with cash?

Yes, buyers save money by avoiding lender fees like loan origination, underwriting, and appraisal costs. While they still pay for title and recording fees, a cash sale eliminates many of the expenses tied to traditional financing. The process is also faster and less likely to fall through.

Can sellers refuse to pay any costs?

Yes, sellers can negotiate to have the buyer cover all closing costs, especially in competitive markets or when the buyer is an investor. However, in most standard deals, sellers are still responsible for transfer taxes, title fees, and any prorated property taxes unless negotiated otherwise.

What’s different in an investor cash sale?

When selling to an investor like 48Acquisitions, the process is typically faster, simpler, and more cost-efficient. Investors often cover most or all closing costs, buy properties as-is, and close on a flexible timeline. This lets sellers avoid repairs, commissions, and months of uncertainty that come with traditional sales.