After a house fire, the thought of selling can feel impossible. You may be facing smoke damage, structural issues, or an unsafe living space. Add in the stress of insurance claims and the cost of repairs, and it’s no wonder many homeowners feel overwhelmed. The good news is you don’t have to fix everything to move forward.

Today, more buyers are willing to purchase fire-damaged homes as-is. That means you can skip the repairs, avoid real estate commissions, and still get a fair cash offer. Whether you’re dealing with partial damage, a total loss, or something in between, there are safe and reliable ways to sell, quickly and on your terms.

Can You Sell a Fire-Damaged House?

Yes, selling a fire-damaged house is not only possible, but it’s often the most innovative way to move forward without sinking money into costly repairs. If your home has suffered from smoke, heat, or structural damage, there are still buyers who are willing to purchase it precisely as it is.

Why Homeowners Choose to Sell After a Fire

For many, the cost and stress of rebuilding aren’t worth it. Here’s why homeowners often decide to sell:

Common Reasons to Sell a Fire-Damaged Home:

- Repairs are too expensive or not covered fully by insurance

- Living conditions are unsafe or unlivable.

- Time-sensitive situations like job relocation or family emergencies

- The emotional impact of staying in a fire-damaged home

- Desire to avoid the traditional real estate process

Types of Buyers Who Purchase Fire-Damaged Homes

Not all buyers are looking for move-in-ready homes. There’s a strong market of investors, rehab specialists, and cash buyers who actively seek out fire-damaged properties.

These buyers are typically:

- Looking to renovate or rebuild

- Comfortable taking on as-is properties

- Able to close quickly with minimal contingencies

Selling to these types of buyers means you don’t have to repair, stage, or even clean the property. You can sell your fire-damaged house in its current condition, and often within days.

How Buyers Help Homeowners Sell Fire-Damaged Houses Fast

When a house has been damaged by fire, speed matters. Whether the damage was recent or lingering from an older incident, finding a buyer who specializes in as-is properties can help you avoid delays, paperwork, and renovation costs.

What to Expect from Buyers Who Purchase Fire-Damaged Homes

These buyers are often real estate investors or property rehab professionals. Their process is designed to be quick, flexible, and low-pressure.

Here’s how they typically help:

- No repairs required – they purchase homes in their current condition

- Fast cash offers – often within 24 to 48 hours of viewing the property.

- Flexible closing dates – you choose when to move out

- No agent commissions or fees – saving you thousands at closing

Why This Process Works for Fire-Damaged Homes

Traditional real estate listings depend on a house being safe, clean, and show-ready. However, when a property has visible damage, smoke odor, or structural concerns, it becomes more challenging to attract conventional buyers or secure financing approval.

Selling directly to a buyer who specializes in fire-damaged houses:

- Skips the inspection-driven delays

- Avoids buyer financing complications

- Eliminates open houses and listing prep

- It gives you control over the timeline

For homeowners looking to sell a fire-damaged house fast, this option provides the most straightforward path forward, without the pressure to fix up what’s already overwhelming.

Everyday Situations We Help With

Fire damage rarely comes alone. For many homeowners, it’s one part of a bigger situation, whether that’s dealing with insurance, a change in living conditions, or emotional strain. That’s why selling makes sense for more than just financial reasons.

One common challenge is navigating the insurance process. While policies may cover repairs, delays in payouts or disputes over claim amounts can stall recovery efforts. In some cases, insurance only covers partial damage, leaving homeowners with a hefty repair bill they weren’t prepared for. Some homeowners decide to sell the house as-is while the insurance claim is still being processed. However, it’s important to consult your insurer or an insurance advisor before finalizing a sale to understand how payouts may be affected.

Another situation is when fire damage leads to safety code violations. If the structure is deemed unsafe by local authorities, staying in the home may not be an option. Repairs required to meet the code can be expensive and time-consuming, especially when permits and inspections are involved. In these cases, selling the home in its current condition can help you avoid additional fines or delays while still preserving the property’s value.

Some homes only suffer partial damage, such as a single room, the attic, or areas with heavy smoke. Even then, homeowners often struggle to return. The smell, the cleanup, and the emotional weight of what happened can be too much. Trying to renovate while reliving the event is not something everyone wants to go through. Selling the house allows for emotional closure and a fresh start elsewhere without the burden of construction or long timelines.

Finally, there are cases where the fire was part of a larger life event, such as a death in the family, financial hardship, or sudden relocation. These situations add urgency and complexity, making the idea of managing contractors and agents even less appealing. In these cases, a simple sale provides clarity and relief.

Choosing to sell a fire-damaged house isn’t just about getting out; it’s about choosing a safer, faster, and more manageable way forward. The right buyer understands these circumstances and works with you to keep things simple, respectful, and timely.

What to Expect When Selling a Fire-Damaged Property

Selling a fire-damaged house is a different experience from listing a traditional home. The process is designed to be faster, more flexible, and far less demanding, primarilywhen working with buyers who understand the unique challenges of post-fire properties.

The first step usually involves a short walkthrough or virtual assessment. Buyers know what to look for: the extent of the damage, the amount of the structure that remains intact, and whether the home is accessible. Unlike traditional buyers, they aren’t alarmed by smoke stains, burned walls, or missing drywall. They’re prepared to evaluate the property based on its current condition, not on its potential for immediate move-in.

Once the property is reviewed, the next step is receiving a cash offer. Offers are typically made within 24 to 48 hours and are based on local market data, repair estimates, and the land value when applicable. The key difference is transparency. There are no drawn-out negotiations or bait-and-switch tactics. You’ll know exactly what’s being offered, with no pressure to accept.

If you decide to move forward, the closing process is straightforward. Because these buyers aren’t relying on mortgage approvals, you won’t be stuck waiting on bank paperwork or underwriting. Most sales close in less than two weeks, sometimes as quickly as seven days. You choose the timeline that works for you, and aprofessionals handle all closing detailsto ensure everything is done legally and securely.

There are also no hidden fees or commissions. With direct buyers, what’s offered is what you walk away with. That’s a significant benefit for homeowners who have already absorbed unexpected costs after the fire: no out-of-pocket expenses, no agent cuts, just a clean, final number.

Overall, the process of selling a ffire-damagedhouse is designed for ease. It removes the usual obstacles and gives you a clear, fast path to move forwardi out pressure, cleacleanup financial risk.

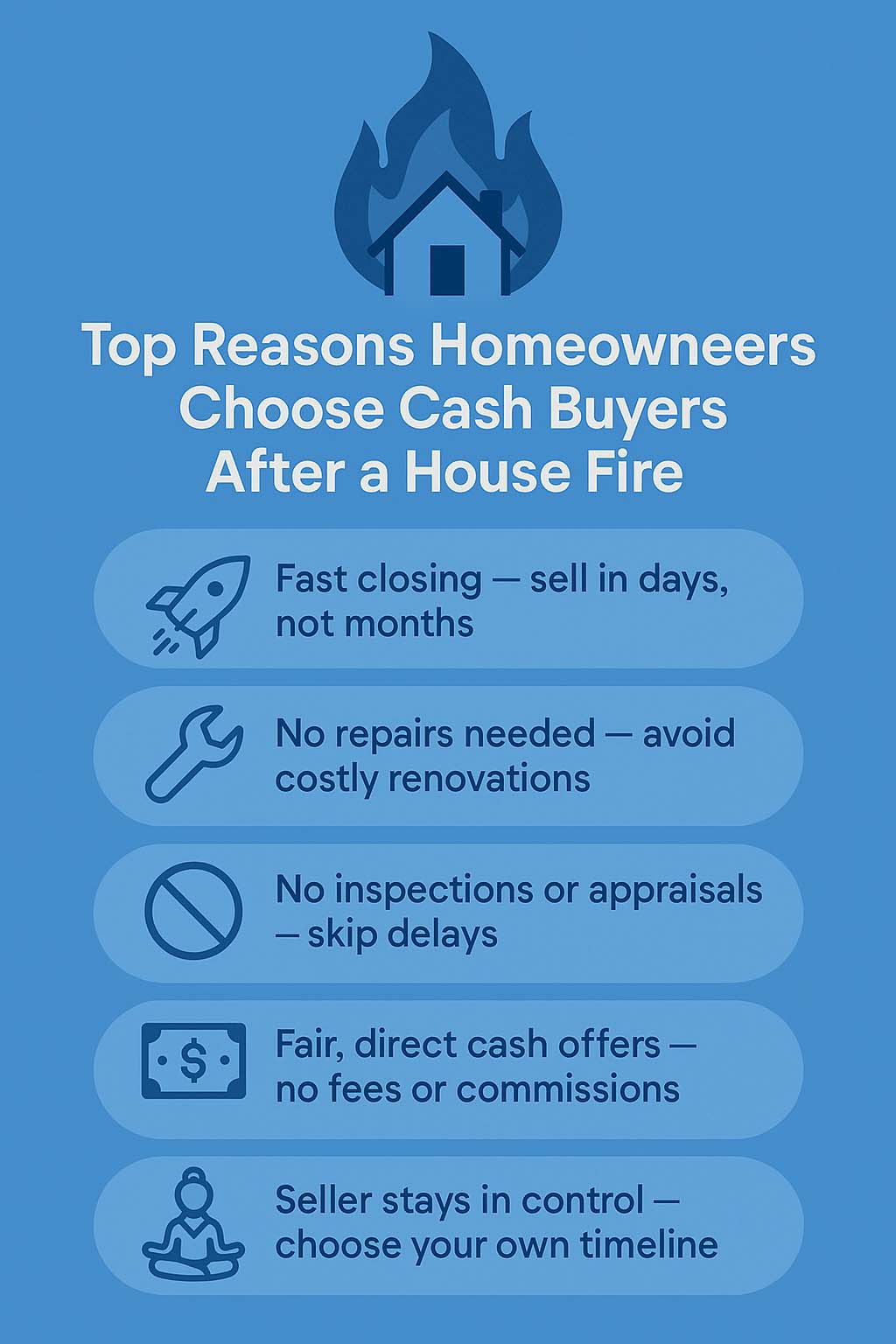

Why Homeowners Choose Cash Buyers for Fire Damaged Homes?

When a house has suffered fire damage, traditional selling methods can often exacerbate an already difficult situation. That’s why many homeowners turn to cash buyers as a safer, faster, and more practical solution.

Unlike listing with a real estate agent, which can involve months of showings, negotiations, and repair work, cash buyers offer a direct and stress-free alternative. Below are the core reasons why sellers prefer this path, especially when facing fire-related damage.

Ready to Sell Your House Fast?

If you’re ready to experience a fast, hassle-free home sale, contact 48Acquisitions today. Don’t delay – get cash for your house fast and move on to your next chapter with confidence.

Speed Matters When You’re Dealing With Fire Damage

Time is critical after a fire. Whether you’re trying to avoid additional repair costs, move quickly due to safety issues, or handle urgent personal matters, the traditional real estate market often can’t move fast enough.

Why speed is so important:

- Insurance deadlines may force you to act quickly

- Utility shutoffs or code violations can make living in the home impossible.

- Temporary housing costs add up the longer the sale drags o.n

- Emotional recovery is delayed when the damaged home is still in your life.

Cash buyers often close in as little as 7 days, giving homeowners immediate relief and the ability to start fresh.

No Repairs or Cleaning Required

Traditional sales often require thousands of dollars in repairs just to get the home market-ready. However, with fire damage, those costs can skyrocket, and still not guarantee a buyer.

Cash buyers take your home exactly as it is:

- There is no need to remove the smoke odor

- No structural repairs or demo work

- No hauling debris or clearing out burned rooms

- No staging or deep cleaning

For homeowners already overwhelmed, this is one of the most significant advantages::ell without lifting a finger.

Skip Inspections, Appraisals, and Financing Delays

In a regular sale, buyers usually request an inspection, hire an appraiser, and rely on a bank to approve their mortgage. Each of those steps can delay or completely kill the dea , especially when fire damage is involved.

With cash buyers, the process is smoother:

- No bank appraisals or financing approvals are required

- No waiting on underwriting

- No deal falling apart after inspection day.

- No price renegotiation due to property condition

This is particularly helpful if the fire damage affects the foundation, electrical systems, or roof, areas that instantly raise red flags for lenders.

Transparent, Fair Cash Offers

There’s a common misconception that cash buyers always lowball. While every situation is unique, reputable buyers base their offers on actual market data, location, and repair costs—not just the damage itself.

A fair cash offer typically includes the following:

- The home’s land value

- The cost of necessary repairs

- Current market trends in your neighborhood

- The buyer’s renovation or resale budget

Because there are no real estate commissions or closing fees, the offer you accept is often very close to what you receive. There are no surprise deductions at closing.

You Stay in Control From Start to Finish

Selling a fire-damaged home is an emotional experience. A good cash buyer understands this and puts you, the homeowner in control.

You decide:

- When to schedule the walkthrough

- Whether or not to accept the offer

- When to close the sale

- If you want to sell at all, with no pressure

This control gives many sellers peace of mind at a time when so much feels uncertain. You’re not forced into a quick decision. You’re simply given options, clarity, and support.

FAQs About Selling a Fire-Damaged House

When it comes to selling a house that’s been damaged by fire, homeowners have a lot of questions. Below are some of the most common concernsn along withar, he andpful answers to guide your next steps.

Do I need to make any repairs before selling?

No, you can sell yourfire-damagedd house as-is. Cash buyers expect the property to be in its current condition. Whether the fire caused minor smoke damage or a complete structural loss, you do not need to make any repairs. You also don’t need to clean or clear debris unless you want to;,any buyers will handle everything after closing.

What if I already started repairs? Can I still sell?

Yes. If you’ve already begun repairs but can’t finish them, you can still sell the house in its current condition. Some buyers even prefer partially repaired homes, especially if significant structural work is already completed. Make sure to document any updates or improvements made since the fire;,t can help increase your offer.

Can I sell the property if insurance is still being processed?

Yes, but timing matters. You may be able to sell while your insurance claim is still in process, but it’s important to speak with your insurance provider to clarify whether the payout can be transferred or must be resolved before closing. Professional advice is strongly recommended in these cases. In some cases, you may need to resolve the claim or assign it to the buyer at the time of closing. It’s essential to clarify who will receive the insurance payout —either you or the buyer—before finalizing the deal.

Will buyers purchase a house that still smells like smoke?

Absolutely. Smoke odor is familiar in fire-damaged properties, and experienced buyers are equipped to handle it. They often use professional remediation services after closing. While removing the odor yourself may boost the perceived value, it’s not required to sell.

Can I sell a house that has code violations or is considered unsafe?

Yes, unsafe properties can still be sold as-is. If the home has been flagged for safety concerns or code violations, it may not qualify for traditional financing. However, some cash buyers are experienced in handling such properties. It’s advisable to check with local authorities or a real estate attorney to understand your responsibilities before selling.

What if I live out of state or am unable to visit the property?

Remote sales are a common and entirely possible option. You can sell your fire-damaged house without being physically present. With the right professionals, you can complete the entire transaction remotely, from signing paperwork electronically to closing via mail or wire transfer. A local contact or locksmith can provide access for buyers if needed.

How fast can I close after accepting a cash offer?

Most sales care closed within7 to 14 days. Some buyers offer flexible timelines to fit your situation. If you need more time to plan a move, collect your belongings, or finalize insurance coordination, you can often negotiate a closing date that works best for you.