The pros and cons of a cash offer on a house often arise when homeowners are trying to sell quickly or avoid the hassle of repairs, listings, and drawn-out negotiations. Is it the right move for you?

A cash offer means the buyer skips the mortgage process and pays the full price upfront. For sellers, this can translate into a faster, more certain closing. But it’s not always the highest payout, and the trade-offs matter.

In this guide, we’ll walk you through exactly what a cash offer means, what you gain, what you give up, and how to tell if it’s the right path for your situation. Whether you’re facing foreclosure, relocating, or simply seeking a fresh start, this breakdown is here to help you move forward with clarity.

What Does a Cash Offer on a House Really Mean?

A cash offer on a house means the buyer wants to purchase the home without using a mortgage loan. Instead of waiting for financing to be approved, the buyer already has the full purchase amount available, ready to transfer at closing.

This type of offer changes how the sale process works for you as a seller. Here’s what it means in practical terms:

1. No Bank Involvement

Traditional sales depend on the buyer getting loan approval. That means paperwork, delays, and the risk of the deal falling through. With a cash offer:

- There’s no underwriting process

- A lender requires no appraisals.

- The sale moves directly to closing.

2. Faster and Simpler Closing

Cash buyers can usually close in 7 to 14 days, compared to the typical 30 to 60 days with mortgage-backed offers. That makes it a strong option if you:

- Need to sell quickly due to foreclosure, relocation, or divorce

- Want to avoid showings, open houses, or market uncertainty.

3. The Buyer Pays in Full

While you won’t be handed actual cash, the buyer:

- Uses a wire transfer or certified funds at closing

- Covers the full purchase price upfront, no monthly payments or lender delays

4. Often Bought “As-Is”

Many cash offers come from:

- Real estate investors

- House flippers

- Home-buying companies

These buyers typically purchase homes in any condition, which means:

- No repairs or cleaning required

- You skip inspections and contractor bids.

5. Lower Risk of the Deal Falling Apart

Without a loan to wait on, there’s less that can go wrong. Once the buyer verifies the property and agrees on terms, the deal is usually solid.

How It Works Without a Mortgage

When a buyer makes a cash offer, the home sale skips over the financing process entirely. That makes the transaction faster, more direct, and often less stressful, especially for sellers in a time-sensitive situation.

Here’s what the process typically looks like when there’s no mortgage involved:

- Buyer Submits a Cash Offer

The buyer presents an offer that clearly states it’s not contingent on financing. This removes the biggest uncertainty in most real estate deals: loan approval. - Seller Reviews the Terms

You’ll look at the offer price, timeline, and any requested inspections or contingencies. Even cash buyers may request a basic inspection, but many opt to skip it to expedite the process. - Title and Escrow Are Opened

Just as in a financed sale, the title company verifies ownership history, clears any existing liens, and prepares the necessary documents. But this step moves much faster without a lender involved. - Funds Are Verified and Held

The buyer wires earnest money to escrow, and the full payment is either pre-verified or transferred in time for closing. There are no delays from banks or appraisers. - Closing Happens Quickly

Without financing, the closing can be scheduled in as little as a week. Once documents are signed, you receive your funds directly, no mortgage processing, no waiting.

Who Typically Makes Cash Offers?

Cash offers often come from experienced buyers who are strategic and operating with specific goals in mind. These aren’t always individuals looking for their forever home. In many cases, they’re investors, real estate companies, or individuals with sufficient equity to move quickly and without requiring bank approval.

Real estate investors and flippers are familiar sources of cash offers. They usually look for properties they can buy below market value, improve, and resell for a profit. Because time is money in their business model, they prefer fast closings and minimal contingencies.

Home-buying companies, also known as iBuyers or direct buyers, often make cash offers, especially for homes that need repairs or aren’t market-ready. These businesses focus on convenience, offering sellers the ability to skip listings, open houses, and lengthy negotiations.

In some cases, individuals making a significant life transition, such as retirees downsizing or buyers who just sold a previous home, might also offer cash. They may want to avoid the uncertainty of a mortgage or secure a deal in a competitive market by making a stronger, faster offer.

Regardless of the buyer type, what they all have in common is the ability to move quickly. That can be a significant advantage if you’re looking to sell your home with minimal stress and delay.

Ready to Sell Your House Fast?

If you’re ready to experience a fast, hassle-free home sale, contact 48Acquisitions today. Don’t delay – get cash for your house fast and move on to your next chapter with confidence.

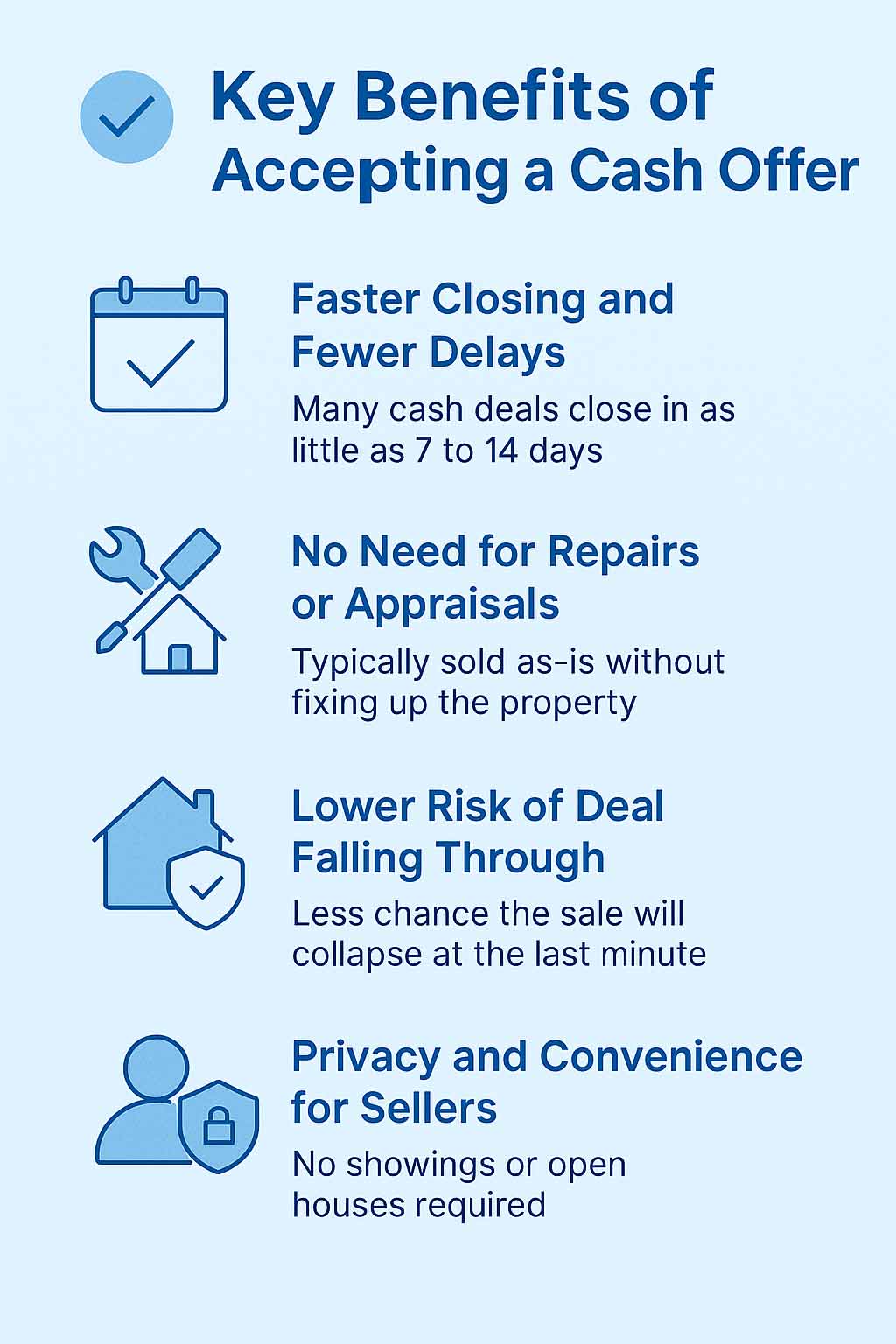

Key Benefits of Accepting a Cash Offer

If you’re trying to sell your home quickly or with less stress, accepting a cash offer can be an innovative solution. These offers eliminate many of the hurdles associated with traditional sales, making the process simpler and faster, especially for homeowners facing time-sensitive or challenging circumstances.

Below are the core benefits that make cash offers so appealing to many sellers:

Faster Closing and Fewer Delays

One of the most significant advantages of a cash offer is speed. Without the need for mortgage approval, underwriting, or lender-required inspections, the entire process moves quickly. In many cases, you can close in as little as one to two weeks. That makes a significant difference if you’re relocating for work, dealing with foreclosure, or simply need to move on fast.

No Need for Repairs or Appraisals

Traditional buyers often ask for repairs or use the appraisal as a negotiation tool. Cash buyers typically skip both. Most are willing to purchase the property as-is, meaning you won’t have to fix broken appliances, repaint walls, or worry about passing a lender’s inspection. This can save you time, stress, and thousands of dollars.

Lower Risk of Deal Falling Through

Mortgage-backed deals often fall through due to financing issues. The buyer might not get final loan approval, even after pre-qualification. With a cash buyer, this risk disappears. Since they already have the funds in hand, there’s much less that can derail the transaction once you accept the offer.

Privacy and Convenience for Sellers

Cash sales are generally quieter and more private. There are no open houses, no strangers walking through your home, and no need to keep everything spotless during showings. If you’re dealing with a sensitive situation, like divorce, probate, or a distressed property, this simplicity can offer peace of mind and emotional relief.

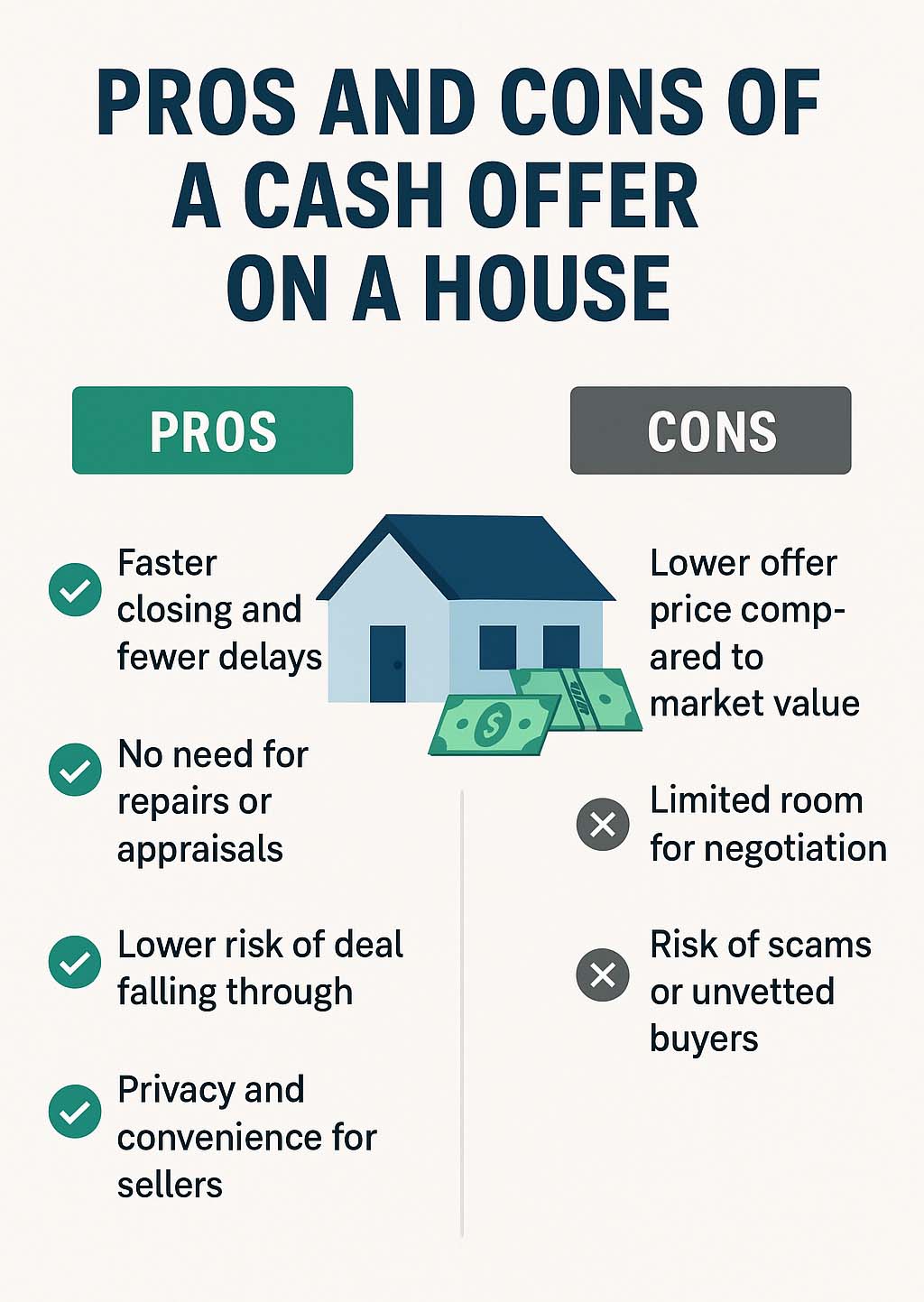

Potential Downsides of Cash Offers

While a cash offer can make the selling process easier, it’s not always the best financial choice for every homeowner. There are real trade-offs to consider, especially if your top priority is getting the highest possible price for your property.

Here are some of the most common drawbacks sellers should be aware of:

Lower Offer Price Compared to Market Value

Cash buyers typically aren’t paying top dollar. In many cases, they offer less than market value in exchange for speed and convenience. Investors and home-buying companies need room to make a profit, especially if they plan to renovate and resell the property. If your home is in good condition and you’re not in a hurry, listing it on the open market could potentially bring in a higher price.

Limited Room for Negotiation

Unlike traditional buyers who might negotiate on price, closing costs, or contingencies, many cash buyers present take-it-or-leave-it offers. They often run on streamlined systems that prioritize volume and efficiency. This can leave you with less flexibility, especially if you were hoping to negotiate a few extra weeks to move out or cover closing fees.

Risk of Scams or Unvetted Buyers

While many cash buyers are legitimate, the industry does attract bad actors. Scammers may target homeowners in financial distress, offering deals that sound too good to be true, because they are. Always verify that the buyer has real funds, uses a reputable title company, and follows a transparent process. If something feels rushed or unclear, it’s worth taking a moment to slow down and seek a second opinion.

When a Cash Offer Might Be Right for You

A cash offer isn’t the perfect solution for everyone, but in certain situations, it can make your life a lot easier. If you’re facing pressure, uncertainty, or unexpected responsibility, a quick and reliable sale might be the best path forward.

Here are some situations where accepting a cash offer could be the right choice:

- You’re Facing Foreclosure or Behind on Payments

If the bank is threatening foreclosure or you’re struggling with missed mortgage payments, time is of the essence. A cash buyer may be able to close quickly, sometimes before the foreclosure process is completed. However, timelines can vary, so it’s important to speak with a real estate attorney or foreclosure specialist to understand your options. - You Inherited a Property You Don’t Want to Keep

Inherited homes can involve emotional decisions, needed repairs, or coordination between family members. A cash sale may offer a simpler option, but it’s wise to consult an estate or probate professional to ensure everything is handled properly. - You Need to Relocate Fast

Whether it’s a job transfer, family emergency, or sudden life change, waiting 30 to 60 days for a traditional sale isn’t always realistic. Cash buyers can close in aas little as week or two, gprovidingyou fwith lexibility and peace of mind. - The Home Needs Major Repairs

If your property has structural issues, plumbing problems, or a long list of deferred maintenance, selling to a traditional buyer may be tough. Cash buyers often specialize in properties that need work, and they won’t ask you to fix a thing. - You Want a Simple, Private Sale

Not everyone wants the stress of cleaning, staging, and letting strangers tour their homes. A cash sale can bea quiet and discree processt, with fewer steps and minimal disruption to your daily life.

How to Evaluate a Cash Offer the Right Way

Receiving a cash offer can feel like a relief, especially if you’re dealing with a stressful situation, but it’s still essential to take a step back and carefully evaluate the offer. Not all cash buyers are the same, and not every deal is as good as it seems on the surface.

Start by comparing the offer to your home’s market value. A lower price might be acceptable if you’re gaining speed, convenience, and peace of mind, but you should still know what you’re trading off. Look at recent sales in your area, or ask a local agent for a rough estimate. Even if you’re not listing on the open market, it’s helpful to have a baseline for what your home could realistically sell for.

Next, consider the credibility of the buyer. Are they local? Have they closed other deals in your area? Can they show proof of funds? A reputable cash buyer will be transparent about who they are, how the process works, and where the money is coming from. If anything feels vague or rushed, that’s a red flag.

You should also think about your bottom line. What do you need to walk away with to move forward comfortably? Factor in any unpaid bills, moving costs, and your timeline. A fair cash offer should make your life easier, not more uncertain.

Finally, don’t be afraid to ask questions. A serious buyer will take the time to explain their process, address your concerns, and ensure you feel confident before proceeding.

Alternatives If a Cash Offer Doesn’t Feel Right

A cash offer isn’t the only way to sell your house, and it’s perfectly okay if it doesn’t feel like the right fit. Depending on your timeline, financial goals, and the condition of your home, there may be better options that give you more control or a higher return.

One common alternative is listing your home on the open market with a real estate agent. This approach typically takes longer, but it can result in a higher sales price, especially if your home is in good condition and you’re in a seller’s market. You’ll need to prepare for showings, negotiate with buyers, and possibly make repairs; however, the upside is the potential for greater profit.

Another option is selling the home as-is through a traditional listing. Some buyers are open to purchasing properties that need work, especially in desirable neighborhoods. While this route may still involve inspections and price negotiations, it can attract buyers who are willing to take on a project in exchange for a lower price.

You can also explore hybrid solutions. Some real estate companies now offer programs that combine elements of a cash sale with traditional listing benefits. For example, they may cover the cost of repairs or provide a guaranteed backup if your home doesn’t sell within a set time. These options can provide flexibility while still protecting your ability to get a fair price.

The right path depends on your priorities. If speed and simplicity are your top priorities, a cash offer may still be your best choice. But if you’re willing to take on a little more work, other selling methods could offer a stronger financial outcome.

Frequently Asked Questions About Cash Offers

Do cash offers always mean a lower sale price?

Not always, but often. Cash buyers typically offer below market value in exchange for speed, convenience, and buying the home as-is. However, for many sellers, the trade-off is worth it, especially when avoiding repairs, agent fees, or months of uncertainty.

Can I still negotiate a cash offer?

Yes, you can. While some cash buyers present firm offers, many are open to adjusting terms like the closing date, included fees, or even the price, especially if your home is in good shape or there’s competition for it. Don’t be afraid to ask.

Is it safe to sell my house for cash?

It can be very safe, if you work with a reputable buyer. Always check for proof of funds, ask who will handle closing, and confirm that the buyer uses a licensed title company. Avoid anyone who pressures you to sign quickly or skips basic paperwork.

What types of homes do cash buyers usually purchase?

Cash buyers often seek properties that need repairs, are being sold due to inheritance, or are at risk of foreclosure , especially when sellers are looking for a simpler process.

How fast can I close with a cash offer?

Most cash sales close in 7 to 14 days, depending on the title company and whether there are any liens or issues to resolve. That’s significantly faster than the typical 30- to 60-day timeline with mortgage-backed offers.

Do I need to clean or fix anything before selling for cash?

In most cases, no. Cash buyers purchase homes in their current condition. That means you don’t have to clean, stage, or repair anything unless you want to, and many sellers don’t.