Selling your home can feel overwhelming, especially when you’re trying to figure out what’s required and what isn’t. One of the biggest questions homeowners ask is whether they need a home appraisal to sell their house.

The short answer? No, an appraisal is not required to sell your home. But depending on your situation, it might be helpful, or it might just be an added expense.

This guide breaks down when an appraisal makes sense, when it doesn’t, and how you can avoid the hassle altogether by working with experienced cash buyers like 48Acquisitions.

What Is a Home Appraisal and How Does It Work?

A home appraisal is a professional estimate of your property’s value, typically conducted by a licensed appraiser. It’s based on your home’s condition, location, and recent sales of similar homes nearby.

Appraisers visit the home to assess its size, features, upgrades, and overall condition. They compare it to recent sales, also called “comps”, in your area. Once the review is complete, they deliver a written report with a valuation.

This figure helps lenders decide how much financing they’ll provide to a buyer. But if you’re selling to a cash buyer or listing the home without a loan involved, you may never need an appraisal at all.

Are You Required to Get an Appraisal Before Selling?

In most cases, homeowners are not required to get an appraisal in order to sell, unless specific legal or financial circumstances apply.

If a buyer is using a mortgage, their lender will usually order an appraisal to confirm the home’s value. But as the seller, you don’t have to get one in advance. In fact, many homeowners sell without ever paying for an appraisal, especially when working with a cash home buyer or listing the home for sale by owner (FSBO).

That said, there are certain situations where a pre-listing appraisal can give you clarity, such as during a divorce, estate settlement, or if you’re pricing a very unique property.

Situations Where a Pre-Sale Appraisal Might Help

A pre-sale appraisal can be helpful when your home is difficult to price or when legal or emotional circumstances are involved.

Here are common situations where an appraisal might make sense:

- Inherited homes: If you’ve inherited property and aren’t sure what it’s worth, an appraisal offers a neutral, documented value.

- Unique or hard-to-value properties: Custom homes, rural properties, or houses with unusual layouts can be harder to compare. An appraisal helps establish fair pricing.

- For sale by owner (FSBO) listings: Without a real estate agent’s help, a formal appraisal can guide your pricing.

- No recent market activity nearby: If few homes have sold in your area recently, comps may be limited, making it harder to price accurately.

- Divorce or legal settlements: In some legal situations like divorce or estate settlements, an unbiased appraisal may be requested to assist in dividing assets. Requirements vary depending on the court and location.

In these situations, a professional appraisal can provide peace of mind and avoid pricing disputes.

When You Can Skip the Appraisal

You can skip the appraisal when you’re selling to a cash buyer or if your priority is speed and convenience over setting a perfect list price.

Here are a few times an appraisal likely isn’t worth the cost:

- Selling to a cash buyer: Cash buyers don’t need lender approval, so no appraisal is required. The sale is based on a mutual agreement of value.

- Selling as-is: If your home needs repairs and you’re not planning to fix them, an appraisal won’t change your offer from an investor or home buying company.

- You already have solid comps: In hot markets with lots of recent sales, a local expert or real estate agent can give you a reliable estimate without formal appraisal costs.

- You’re more focused on timeline than top dollar: Some sellers prioritize a quick exit over squeezing out every dollar. In these cases, an appraisal adds unnecessary steps.

In short, if your goal is a fast, easy sale, especially without agent fees or buyer delays, you likely don’t need an appraisal.

Appraisal vs. Comparative Market Analysis (CMA): What’s the Difference?

An appraisal is a licensed professional’s opinion of value, while a CMA is a pricing estimate prepared by a real estate agent based on similar homes nearby.

Appraisals are typically required by lenders and cost several hundred dollars. They’re conducted by certified appraisers and are considered more formal and objective.

CMAs, on the other hand, are often free. Agents use local sales data and their experience to suggest a listing price. While less official than an appraisal, a CMA can be very accurate, especially if the agent knows your neighborhood well.

If you’re not selling through a traditional listing or don’t want to pay for an appraisal, a CMA or even a quick estimate from a home buying company may be all you need to move forward.

What Does a Home Appraisal Cost, and Who Pays?

A typical home appraisal costs between $300 and $500, though prices can go higher depending on your home’s size, location, and complexity.

In most traditional sales, the buyer’s lender orders and pays for the appraisal. However, if you choose to get a pre-sale appraisal yourself, for pricing guidance or legal reasons, you’ll be responsible for the fee.

Keep in mind: this is a non-refundable upfront cost. And if your buyer later orders their own appraisal, your version might not carry weight with their lender.

If your goal is to sell quickly or avoid upfront expenses, you may want to skip the appraisal altogether and work directly with a cash home buyer.

How a Cash Offer Can Make the Process Easier

A cash offer eliminates the need for an appraisal, lender delays, or financing conditions, making your sale faster and smoother.

Here’s why many sellers prefer cash buyers:

- No lender-required appraisal: Cash buyers don’t need a loan, so there’s no risk of the deal falling through due to a low valuation.

- Fast closings: Without bank approvals or third-party delays, sales can close in as little as 7 days.

- No repairs or showings: Cash buyers often purchase homes as-is, so you won’t need to prep the home or spend on improvements.

- Fewer contingencies: Traditional buyers may ask for appraisal, loan, or inspection contingencies. Cash buyers keep it simple.

If you want certainty and control in your sale, a cash offer from a reputable home buying company can take the stress out of the process.

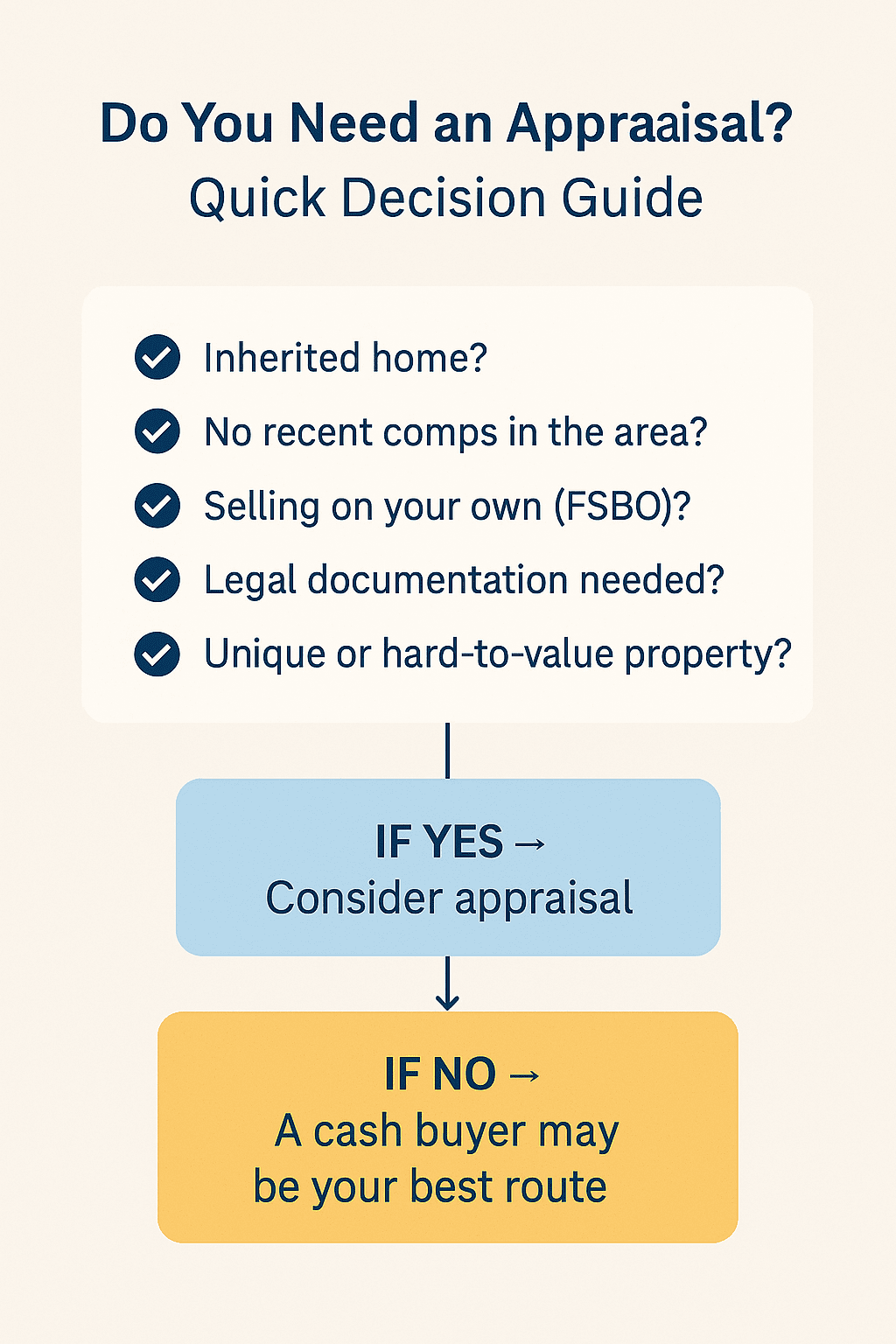

Should You Get a Pre-Sale Appraisal? Here’s a Quick Checklist

Not sure if a pre-sale appraisal is right for you? Use this simple checklist to decide:

- Is your home unusual or hard to price?

- Are there few recent sales nearby to compare?

- Are you selling during a divorce, estate settlement, or legal process?

- Are you listing the home without an agent?

- Do you need solid documentation for your asking price?

If you answered “yes” to one or more of these, a pre-sale appraisal may give you peace of mind and help avoid price disputes.

If you answered “no,” or your main goal is a fast, low-hassle sale, you likely don’t need one, especially if you’re considering a cash buyer.

How 48Acquisitions Makes Selling Easy Without an Appraisal

You don’t need an appraisal to sell your house when you work with 48Acquisitions. We buy homes directly from homeowners, fast, as-is, and without the usual red tape.

Here’s what sets our process apart:

- No appraisals needed: We use local market data and real-world expertise to make you a fair cash offer, no banks or formal valuations required.

- Sell your home as-is: Skip the repairs, cleaning, or staging. We buy houses in any condition.

- Fast closings on your schedule: Need to move in 7 days? Prefer to wait a few weeks? We’ll work with your timeline.

- No commissions or fees: You get the full amount we offer, no hidden costs.

Whether you’re relocating, inheriting property, or just want a simpler way to sell, we’re here to help make the process safe and stress-free.

Frequently Asked Questions

Do I need an appraisal to sell my house for cash?

No, cash buyers like 48Acquisitions don’t require an appraisal. We assess your property ourselves and make a fair offer without lender delays.

Can I set my own price without an appraisal?

Yes, you can. Many homeowners use online tools or local market data to set a price. Just be realistic to avoid scaring away buyers or delaying your sale.

What if my appraisal comes in too low?

If a lender’s appraisal is too low, it can affect financing for a buyer. This often leads to price renegotiations or lost deals. That’s why many sellers prefer cash buyers, who don’t rely on appraisals.

Will buyers still ask for an appraisal?

Only if they’re using a mortgage. Buyers paying in cash typically won’t request one unless they choose to for personal reasons.