Yes, you can absolutely sell your house in foreclosure, as long as the final auction hasn’t taken place yet. If you’re behind on mortgage payments or have already received a foreclosure notice, you still have options. Selling your home before the process is complete can help you avoid long-term credit damage, stop the foreclosure from proceeding, and give you the financial freedom to move forward.

At 48Acquisitions, we specialize in buying houses during foreclosure. We move quickly, handle the paperwork, and work directly with your lender when needed, so you don’t have to face this alone. Whether you’re weeks away from a scheduled auction or just starting to fall behind, we’re here to help make the process simple and stress-free.

What Foreclosure Really Means for Homeowners

Foreclosure is a legal process where your lender takes steps to reclaim your property because of missed mortgage payments. It doesn’t happen overnight, but once it starts, the timeline moves quickly, often faster than most homeowners expect.

If you’re facing foreclosure, you’re not alone. It usually begins after 3–6 months of missed payments and ends in a public auction or repossession by the lender. During this time, you still have the right to sell your home and avoid the lasting impact foreclosure can leave on your credit, finances, and peace of mind.

Understanding where you are in the process helps you take action early, before the window to sell closes.

The difference between pre-foreclosure and foreclosure

Pre-foreclosure is the period after missed mortgage payments begin but before the home is officially repossessed or auctioned. During this stage, your lender has likely issued a notice of default, but you still legally own the home and can sell it to avoid foreclosure.

Once the foreclosure is finalized, meaning the auction has occurred or the bank has taken ownership, you lose the right to sell the property. That’s why acting during pre-foreclosure is critical. Selling your home at this stage can protect your credit score, prevent legal complications, and allow you to move on without owing additional debt.

How the foreclosure process works, step by step

The foreclosure process starts with missed payments and ends with the lender taking ownership of your home if no action is taken. Here’s how it typically unfolds:

- Missed Payments – Most lenders begin the process after 3 consecutive missed mortgage payments.

- Notice of Default – You receive a formal letter warning that foreclosure will begin unless the loan is brought current.

- Pre-Foreclosure Period – This is your window to act. You can sell your home, request a loan modification, or negotiate with your lender.

- Foreclosure Filing – In judicial states, the lender files a lawsuit. In non-judicial states, the process may move faster without court involvement.

- Public Auction – If you don’t resolve the issue, the lender will schedule your home for auction and sell it to the highest bidder.

- Eviction – If the property sells at auction or reverts to the lender, you may be given notice to vacate.

Each state has different rules and timelines, but the key takeaway is this: you have options up until the final sale date, and selling your home is one of the most effective.

Can I Sell My House to Avoid Foreclosure?

Yes, you absolutely can. Selling the home may help some homeowners avoid foreclosure-related consequences. However, results vary depending on state laws and lender policies. Whether you’re just entering the pre-foreclosure phase or you’ve already received a notice of default, listing your home or selling directly to a cash buyer can help you regain control of your finances.

At 48Acquisitions, we help homeowners sell quickly so they don’t have to face foreclosure alone. We understand the pressure of looming deadlines and financial strain. That’s why we offer a fast, simple process that lets you close on your timeline, often in just seven days. If you’re in foreclosure, selling now could protect your credit, preserve your equity, and help you move forward with peace of mind.

Don’t wait until the auction date is around the corner. The earlier you take action, the more solutions you have. Reach out to us today for a fair, no-obligation cash offer and find out how easy it is to stop foreclosure through a quick home sale.

Yes, You Can Sell Your House in Foreclosure – Here’s When and How

You can sell your house in foreclosure anytime before the auction is complete, but the sooner you act, the better your outcome. Many homeowners don’t realize they still have full ownership rights until the final sale. That means you can list the property, accept offers, and even work with a cash buyer, provided you move quickly.

At 48Acquisitions, we help homeowners in foreclosure close fast and avoid the stress of losing everything. Whether you’re in pre-foreclosure or already received a notice of sale, selling directly to a home buying company is often the fastest and safest route. Our team takes care of the paperwork and works directly with your lender if needed, so you don’t get buried in legal delays or last-minute surprises.

Selling before the foreclosure is final

Selling your home before the foreclosure is finalized is not only possible, it’s the best way to avoid lasting financial damage. In many cases, homeowners may still be able to sell their property before the foreclosure auction, but laws vary by state. It’s a good idea to consult with a local professional to understand your specific rights.

During this window, you can work with a cash buyer to close quickly, settle your loan balance, and walk away without the stigma of foreclosure on your credit report. This option also protects your equity, which may be lost if the home goes to auction for less than it’s worth.

The key is timing. The earlier you reach out, the more control you have over the sale and your financial future.

Selling after receiving a foreclosure notice

Yes, you can still sell your home even after receiving a foreclosure notice, until the auction date, your rights as the homeowner remain intact. The notice simply means the lender has officially started the process, but it doesn’t mean it’s too late.

In fact, this is one of the most common points when homeowners decide to act. Selling at this stage can stop the foreclosure, protect your credit, and help you avoid legal action. You’ll need to move fast, and that’s where cash buyers like 48Acquisitions step in, we can make a fair offer and close in as little as seven days, giving you a clean way out before the clock runs out.

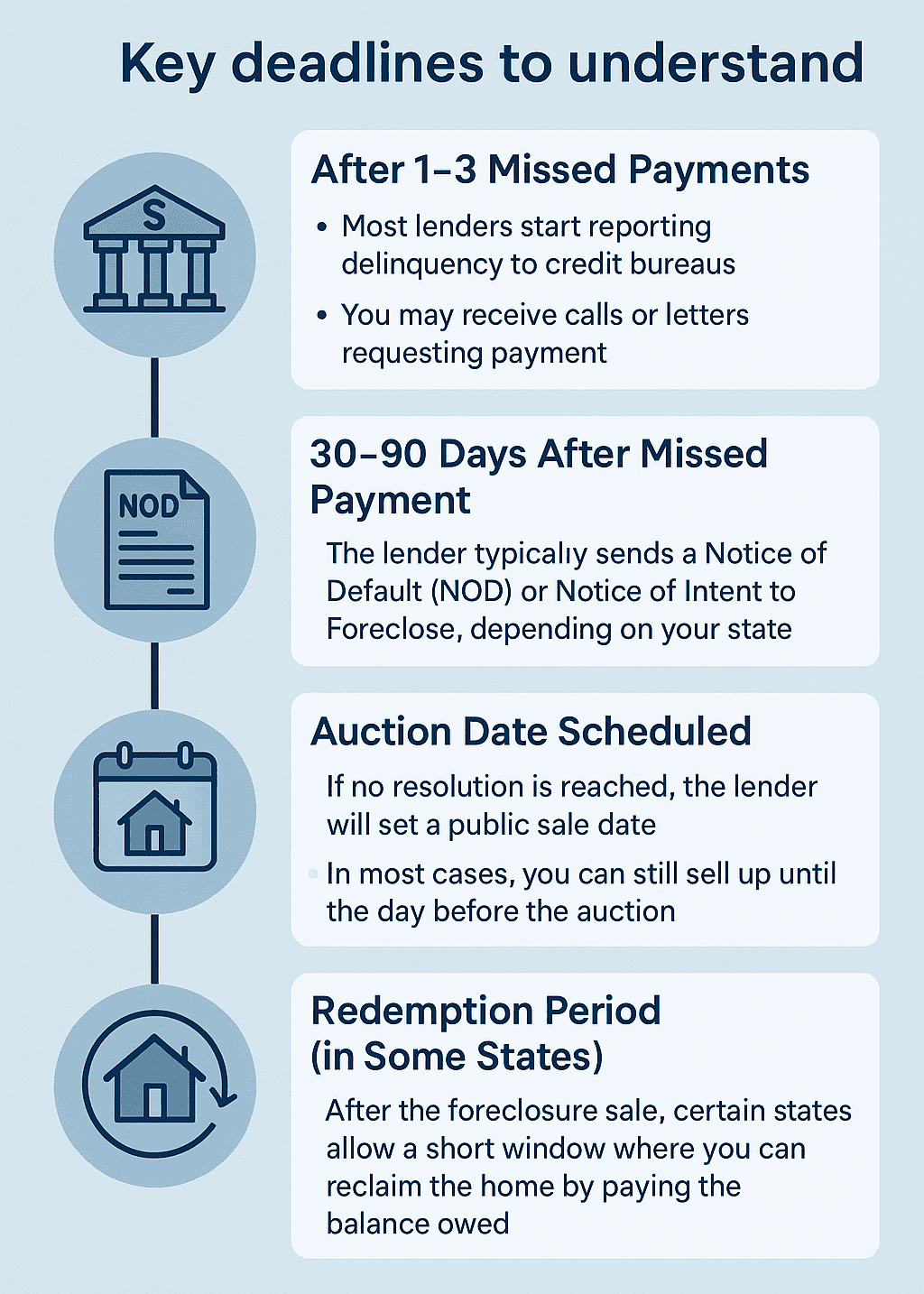

Key deadlines to understand

Selling your home in foreclosure means working against the clock, and missing key deadlines can limit your options. Here’s what you need to know about critical timeframes:

- After 1–3 missed payments:

- Most lenders start reporting delinquency to credit bureaus.

- You may receive calls or letters requesting payment.

- 30–90 days after the first missed payment:

- The lender typically sends a Notice of Default (NOD) or a Notice of Intent to Foreclose, depending on your state.

- Pre-foreclosure period begins:

- You can still sell your home during this stage.

- This is often your best opportunity to avoid credit damage and keep any equity.

- Auction date is scheduled:

- If no resolution is reached, the lender will set a public sale date.

- In most cases, you can still sell up until the day before the auction.

- Redemption period (in some states):

- After the foreclosure sale, certain states allow a short window where you can reclaim the home by paying the balance owed.

Acting early gives you the most flexibility. The moment you receive a foreclosure notice, your timeline is shrinking, selling fast can stop the process entirely.

Why Selling Now Could Be Your Smartest Move

Selling your home before foreclosure is finalized gives you the best chance to protect your credit, keep your equity, and avoid long-term financial setbacks. Once a foreclosure is complete, the impact can stay on your credit report for up to seven years, making it harder to rent, buy, or finance anything in the future.

By selling early, you stay in control. You avoid the uncertainty of auctions, the stress of court filings, and the emotional weight of losing your home publicly. Selling now also lets you walk away with cash in hand, something that’s often impossible once the bank takes over.

A fast, clean sale through a cash home buyer offers peace of mind and a clear path forward. You can move on with your life without dragging the foreclosure burden with you.

Avoiding damage to your credit

Selling your home before foreclosure is finalized is one of the best ways to avoid severe credit damage. Once a foreclosure is reported, it can drop your credit score by 100 points or more, and that hit sticks for years.

By selling early, especially through a fast cash offer, you can resolve the debt and stop the foreclosure from ever appearing on your credit history. Lenders see a resolved sale much more favorably than a completed foreclosure. That means a quicker recovery for your finances and a better chance of qualifying for future loans, housing, or credit cards.

It’s not just about numbers, it’s about protecting your financial future.

Preventing the stress of an auction

Avoiding the foreclosure auction saves you from uncertainty, public exposure, and emotional pressure. Once your home is scheduled for auction, you lose control over the sale price and the timeline. The property is sold to the highest bidder, often below market value, and you’re forced to vacate quickly.

Selling before it reaches that stage gives you privacy and peace of mind. You avoid the fear of strangers bidding on your home and the risk of walking away with nothing. With a direct sale, you choose the closing date, avoid open houses, and move on your terms. It’s faster, cleaner, and far less stressful than waiting for the court or the lender to decide what happens next.

Getting cash fast to move forward

Selling your home in foreclosure can give you access to fast cash when you need it most. If you’re behind on payments, dealing with job loss, or facing other financial stress, waiting months for a traditional sale isn’t realistic.

Cash buyers like 48Acquisitions can close in as little as seven days, no inspections, no appraisals, and no financing delays. You get a fair offer based on your home’s current condition, and you walk away with cash you can use to rent a new place, pay off debts, or get a fresh start.

In a foreclosure situation, time equals opportunity. Selling quickly gives you the breathing room to focus on what comes next, not what’s falling apart.

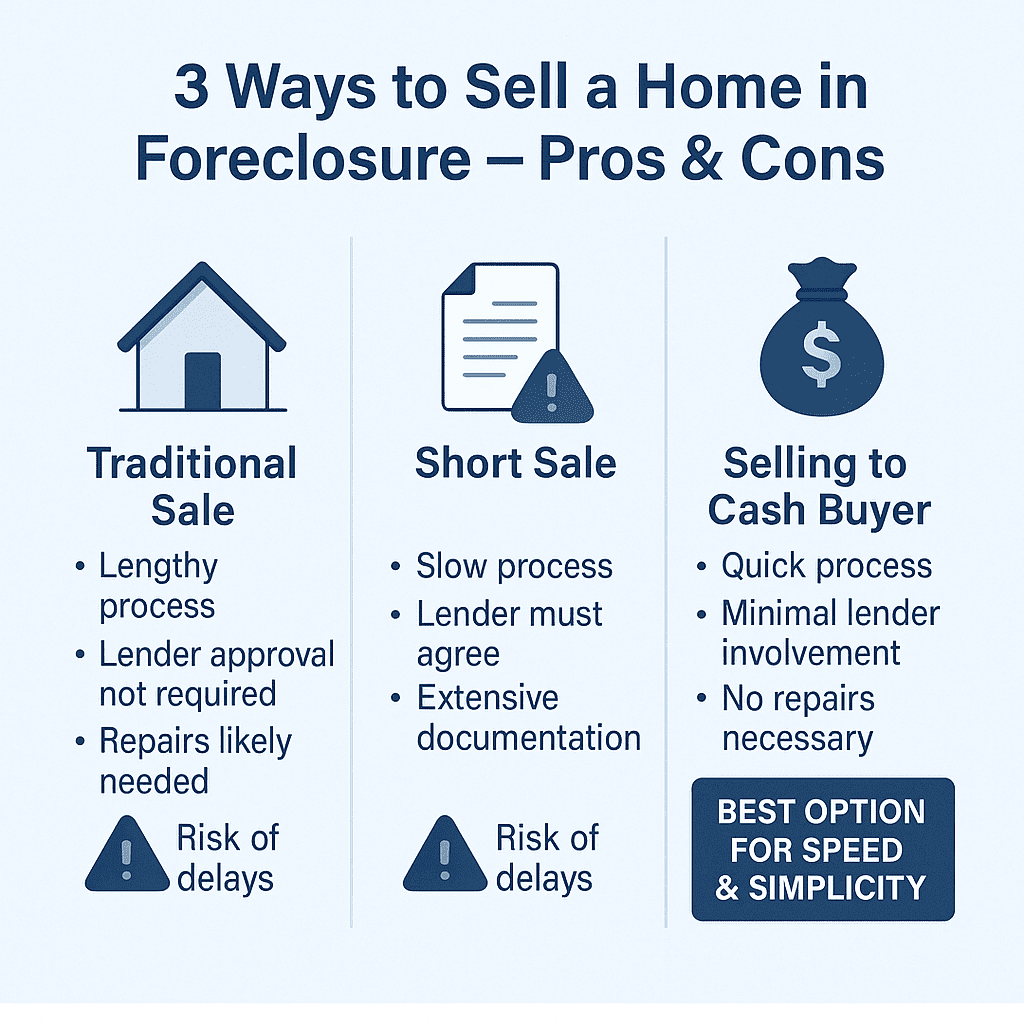

Three Ways to Sell a House in Foreclosure

There are three main ways to sell your house during foreclosure: a traditional listing, a short sale, or a direct cash sale. Each option has its own risks and benefits, depending on how much time you have and how much is still owed on your mortgage.

If you have several weeks or more and your home is in good condition, a traditional listing might be possible, but you’ll need an agent who understands foreclosure timelines. A short sale works if you owe more than the home is worth, but it requires lender approval and often takes months.

The fastest and simplest option is selling directly to a cash home buyer like 48Acquisitions. We buy houses as-is, work with your timeline, and can help you avoid foreclosure entirely.

Traditional sale (with limitations)

You can sell your house through a real estate agent during foreclosure, but only if you have enough time and equity. A traditional sale typically involves repairs, showings, and waiting for buyer financing, all of which may not fit within a tight foreclosure timeline.

If your auction date is weeks away, a listing might not close in time. Buyers can back out, financing can fall through, and the process often takes 30–60 days or more. You’ll also need to factor in agent commissions and closing costs, which can eat into your remaining equity.

While this route can work for some homeowners, it’s rarely the fastest or safest choice when time is limited.

Short sale option

A short sale allows you to sell your home for less than what you owe on the mortgage, with your lender’s approval. It’s often used when the home’s market value has dropped and there’s not enough equity to cover the loan balance.

While a short sale can help you avoid foreclosure and lessen the hit to your credit, it comes with challenges. Your lender must agree to the sale, and the approval process can take weeks, or even months. In the meantime, the foreclosure process may continue unless delayed by the lender.

Short sales are complex and time-sensitive. If you’re considering this path, act quickly and work with a team experienced in negotiating with lenders.

Selling directly to a cash home buyer

Selling to a cash home buyer is the fastest and most reliable way to stop foreclosure and close on your schedule. There’s no need to fix anything, host showings, or wait for financing. You get a fair cash offer based on your home’s current condition, and we handle everything from paperwork to communication with your lender if needed.

At 48Acquisitions, we understand the urgency. We buy houses in foreclosure fast, helping you avoid auction, protect your credit, and walk away with money in your pocket. No fees. No repairs. No delays.

If you’re facing foreclosure, this option gives you speed, certainty, and peace of mind.

What to Expect From the Selling Process

Selling a house in foreclosure doesn’t have to be complicated, especially when you choose the right partner. The process is different from a standard home sale, but it’s still manageable if you act quickly and work with professionals who understand foreclosure timelines.

Here’s what you can expect: First, you’ll need to notify your lender that you’re pursuing a sale. Then, you’ll receive a cash offer based on the home’s current condition. If you accept, the buyer handles the paperwork, coordinates with your lender, and sets a closing date that fits your needs.

At 48Acquisitions, we make this process as smooth as possible. We don’t require repairs, cleanups, or long waiting periods. Just a fast, clear path out, so you can move forward.

Notifying your lender

As soon as you decide to sell your house during foreclosure, notify your lender right away. Communication is key, they need to know you’re taking steps to resolve the debt. In many cases, lenders are willing to pause or delay foreclosure actions if they see that a legitimate sale is underway.

Let them know you’re working with a buyer and provide proof of the sale as soon as it’s available. If you’re working with 48Acquisitions, we can coordinate directly with your lender to help manage the process and ensure everyone stays on track.

Keeping your lender informed may buy you time and prevent the sale from being rushed or blocked.

Getting a cash offer and closing fast

A cash offer allows you to move quickly and avoid the delays that come with traditional sales. There’s no need to wait for appraisals, financing approvals, or inspections. Once we view your property and assess its condition, we provide a fair, no-obligation cash offer, usually within 24 to 48 hours.

If you accept, we will set a closing date that works for you. In many cases, we can close in as little as seven days. You don’t pay any fees, and there are no deductions from your final payout. You walk away with cash in hand and the stress behind you.

It’s the simplest way to sell a home in foreclosure, fast, reliable, and on your terms.

How to sell even with liens or back payments

You can still sell your home in foreclosure even if you owe back payments or have liens, these just need to be resolved at closing. When you sell to a cash buyer like 48Acquisitions, we work with the title company to pay off your mortgage and any outstanding debts tied to the property directly from the sale proceeds.

This includes missed mortgage payments, property taxes, HOA dues, or contractor liens. You don’t need to pay anything upfront. These costs are deducted from the final sale, and any remaining balance is yours.

Even if the numbers seem overwhelming, we’ll walk you through it and explain your options. Selling with debt on the home is more common than you think, and absolutely possible.

Your Legal Rights and Financial Obligations

Even during foreclosure, you still have legal rights as the homeowner, and understanding them is key to making the right decisions. Until the final auction or repossession takes place, you retain full ownership of the property, which means you can sell it, negotiate with your lender, or explore alternatives like a short sale.

It’s also important to know what happens financially if the home is sold for less than you owe. In some cases, lenders may pursue a deficiency judgment for the remaining balance. But with the right guidance, you can often negotiate a full release or walk away with minimal financial burden.

While homeowners in foreclosure often still hold title to the property, the legal and financial details vary greatly by state. It’s important to seek legal or financial guidance to understand your situation. At 48Acquisitions, we help simplify this process and can connect you with the right experts when needed.

Can you stop foreclosure after listing your home?

In some cases, lenders may postpone foreclosure if a sale is in progress, but this depends on state laws and the lender’s discretion. Most lenders are willing to delay or cancel the auction if they see a verified sale in progress that will satisfy the loan or reduce their loss.

Timing matters. The earlier you get your house under contract and notify your lender, the better your chances of stopping the foreclosure. A fast cash sale through 48Acquisitions makes this much easier, we can move quickly and provide all the documentation your lender needs.

Selling the home may be an option to avoid further complications, but it’s important to review all available options with a qualified professional.

Will you still owe money after selling or foreclosure?

If you sell your house for less than what you owe, you might still be responsible for the remaining balance, unless your lender agrees to forgive the difference. This is known as a deficiency balance, and laws about it vary by state.

In some situations, lenders may agree to a short sale, but this often depends on approval and may carry tax or legal consequences. Always consult with a legal or financial advisor. If the home goes through foreclosure and sells at auction for less than the debt, the lender may pursue a deficiency judgment unless prohibited by state law.

Working with a cash buyer like 48Acquisitions can help you avoid these risks. We aim to structure deals that satisfy your lender and prevent lingering debt after the sale.

We Can Help You Sell Fast and Avoid Foreclosure

At 48Acquisitions, we help homeowners in foreclosure sell quickly, skip the stress, and walk away with a fresh start. Our process is designed for speed, simplicity, and peace of mind, no repairs, no commissions, and no waiting around for uncertain buyers.

We understand the urgency foreclosure brings. That’s why we provide fair, no-obligation cash offers and close in days, not months. We’ll even work directly with your lender to handle the paperwork and avoid delays.

Selling your home doesn’t have to feel like giving up. It can be the smartest, most empowering step you take to protect your future. And we’ll be with you every step of the way.

No fees, no repairs, no waiting

When you sell your home to 48Acquisitions, there are zero out-of-pocket costs, ever. You don’t pay agent commissions, repair bills, or closing fees. We buy houses as-is, in any condition, and we move fast so you don’t have to wait.

You won’t have to clean, stage, or spend another dollar trying to fix up your home. We handle the details so you can focus on your next steps. With us, there are no delays, no showings, and no unexpected surprises, just a fast, fair sale when you need it most.

Local expertise that protects your interests

Our deep understanding of your local market means you get a fair offer based on real numbers, not guesswork or lowballing. At 48Acquisitions, we know the neighborhoods, the trends, and the timelines that matter when you’re selling a home in foreclosure.

We’re not a national chain or a faceless investor, we’re local home buyers who care about doing things the right way. That means giving you an honest offer, helping you navigate the process, and respecting your time and situation.

When you’re facing foreclosure, having someone who knows your market and has your back makes all the difference.

How to get your cash offer today

Getting your cash offer is simple, fast, and comes with no obligation. Just reach out to 48Acquisitions with some basic information about your property, like the address and condition, and we’ll take it from there.

We’ll evaluate your home based on local data and current market trends, then send you a fair cash offer within 24 to 48 hours. If you like what you see, you pick the closing date, and we handle the rest. No waiting, no fees, no pressure.

Start the process today and take back control of your situation. We’re ready when you are.

FAQs: Selling a Foreclosed House

If you’re facing foreclosure, you likely have questions, and we’re here to answer them clearly and simply. These are some of the most common concerns homeowners have when trying to sell during foreclosure. Knowing your rights and options helps you make confident, informed decisions.

Whether you’re worried about timing, existing debt, or how the process works with your lender, these answers will give you clarity and direction.

Can I sell my house in foreclosure with a mortgage?

Yes, you can sell your house in foreclosure even if you still have a mortgage, it’s actually very common. When you sell, the proceeds from the sale are used to pay off your remaining mortgage balance and any overdue amounts or fees.

If your home has equity, you may even walk away with cash after everything is paid. If the sale price is less than what you owe, your lender may approve a short sale to help you avoid foreclosure altogether.

At 48Acquisitions, we guide you through this process so you can sell with confidence, even if your mortgage is behind.

Can I sell if my house is already scheduled for auction?

Yes, you can still sell your house right up until the auction takes place, but you need to act fast. As long as the home hasn’t been sold at auction, you remain the legal owner and have the right to sell it.

Once your house is under contract with a buyer and you’ve notified your lender, they may postpone or cancel the auction to allow the sale to go through. The key is having a serious buyer who can close quickly, like 48Acquisitions.

If your auction date is set, don’t wait another day. We can often make an offer and close before the sale happens.

How fast can I close the sale?

With 48Acquisitions, you can close in as little as seven days, sometimes even faster depending on your situation. We buy houses with cash, which means there are no lender delays, inspections, or appraisals to hold things up.

Once you accept our offer, we handle all the paperwork and work with the title company to move things forward quickly. Whether your foreclosure date is approaching or you just want a fast, clean exit, we’ll work on your schedule to make it happen.

Fast doesn’t have to mean complicated. With us, it’s just simple and done.