If you’re dealing with a condemned house, you’re likely facing a mix of stress, confusion, and urgency. Maybe the city has posted warnings, or you’ve received notice that the property can’t legally be occupied. Whether it’s due to fire damage, years of neglect, or a failed inspection, you’re probably wondering, can I still sell it?

The answer is yes. But the process looks different than a traditional home sale.

This guide will walk you through everything you need to know. We’ll explain what “condemned” really means, outline your selling options, and help you understand what to expect, step by step. You’ll also learn why many owners choose to sell condemned homes as-is for cash, avoiding repairs, delays, or legal headaches.

If you’re ready to move on from a difficult property, you’re not stuck. You have options, and we’re here to help you understand them.

What Does “Condemned” Mean for a House?

A condemned house is one that a local government has officially declared unsafe to live in. This typically occurs after a property inspector or building official identifies serious issues that pose a threat to the health or safety of anyone inside. Once condemned, the home is legally off-limits for occupancy until the problems are rectified or the house is demolished.

This doesn’t mean the house is worthless. It just means the city has determined that it currently doesn’t meet minimum standards for habitation. In many cases, the owner can sell the property, even while it’s condemned.

Depending on your location, a condemned notice might come from the city housing department, fire marshal, or health department. Each agency has its own rules, but the outcome is the same: the property can’t be lived in until it’s brought up to code or sold to someone willing to take on the challenge.

Next, we’ll look at what typically causes a house to be condemned, and why it’s not always as extreme as it sounds.

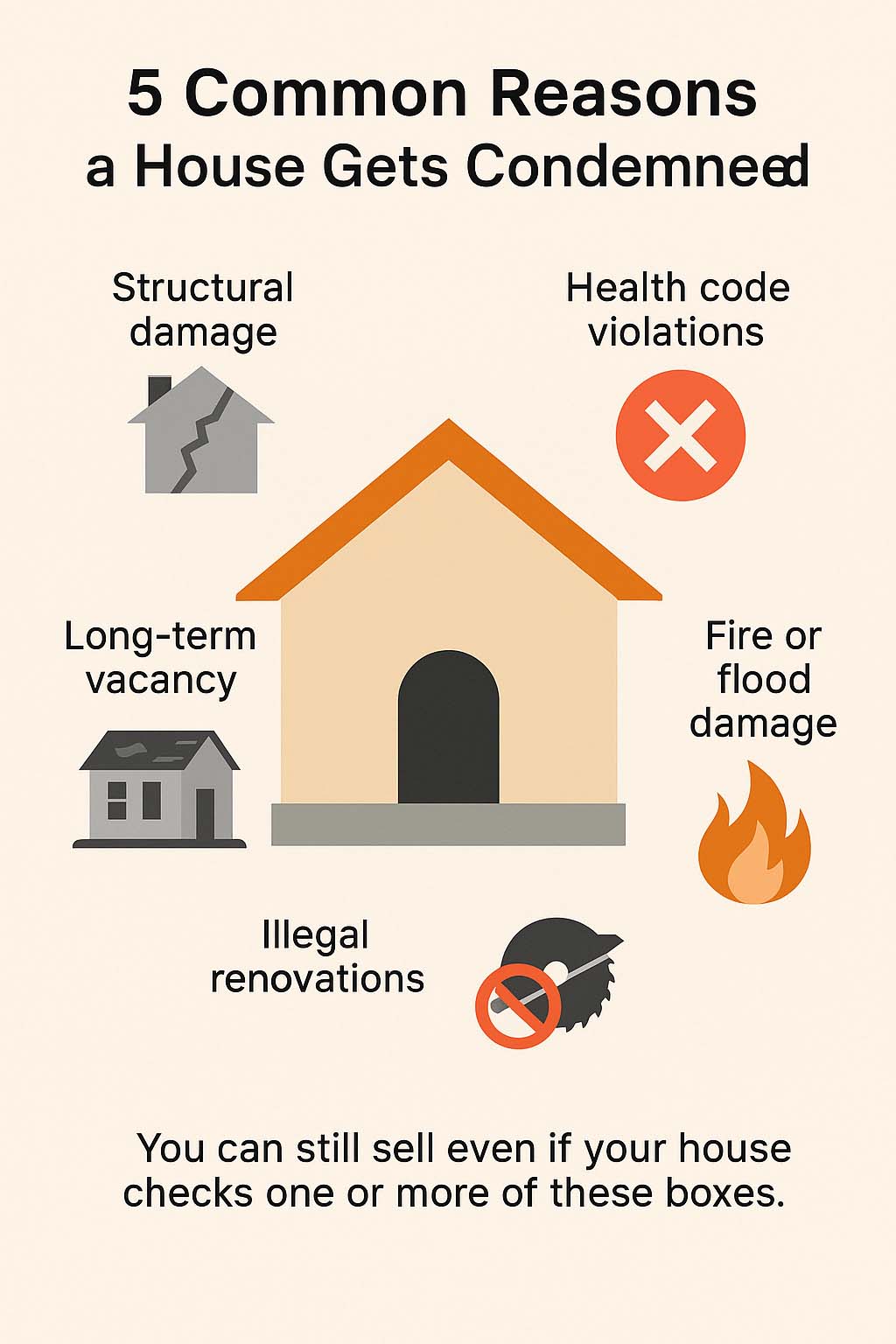

Common Reasons a House Gets Condemned

Houses don’t get condemned overnight. Local authorities typically issue warnings or inspection notices before taking formal action. If the owner doesn’t resolve the issues, the property may be declared uninhabitable.

Here are some of the most common reasons a house gets condemned:

- Severe structural damage – Cracked foundations, collapsed roofs, or unstable walls that make the home unsafe

- Long-term vacancy – Abandoned homes often attract vandalism, pests, or decay, which leads to condemnation

- Fire or flood damage – After major disasters, homes may be unsafe due to smoke, mold, or water intrusion

- Health code violations – Issues like black mold, raw sewage, or severe infestations can trigger condemnation

- Illegal modifications – Unsafe electrical work, plumbing changes, or additions done without permits

- Neglect and disrepair – Broken windows, missing utilities, or extensive trash buildup that poses safety risks

In many cases, these issues are too costly for homeowners to fix. That’s why selling the property, especially to a cash buyer, can be a practical way forward.

Is a Condemned Property Always Unsafe?

Not always. While a condemned property is considered unfit to live in, that doesn’t mean it’s falling apart or dangerous in every case. Some homes are condemned for administrative or legal reasons, rather than physical hazards.

For example, a house might be condemned because:

- Utilities have been shut off for too long

- Permits were never filed for major renovations

- The property has been vacant and unsecured for months or years

In some cases, the structure itself is still sound. But because it doesn’t meet local codes or poses a risk to the neighborhood, it’s placed under a condemnation order.

The key takeaway? A condemned home can often be repaired, sold, or transferred, especially if you’re working with a buyer experienced in distressed properties. You’re not without options. In many cases, homeowners can explore alternatives to abandonment that may help avoid further complications.

Yes, You Can Sell a Condemned House, Here’s How

Many homeowners assume a condemned house can’t be sold, but that’s not true. You have multiple options, even if the city has posted a notice or the property feels beyond saving. The right path depends on your budget, timeline, and goals. Here are the most common ways to move forward:

Sell As-Is for Cash

This is the simplest and fastest option. When you sell your condemned house as-is for cash, you avoid repairs, inspections, and drawn-out negotiations. Cash buyers are often real estate investors or home-buying companies (like 48Acquisitions) that specialize in distressed properties.

Benefits of selling as-is for cash:

- No need to fix anything or clean up.

- Sell your condemned house as-is to a buyer familiar with code compliance and local requirements, potentially reducing your involvement in permitting or repairs.

- Quick closing, often in 7 days or less.

- Skip agent fees, commissions, and showings.

If your home is severely damaged or vacant, selling as-is for cash can help you walk away without delays or added costs.

Repair and Restore First

If you have the time, budget, and energy, making repairs might allow you to lift the condemnation order and sell through traditional channels. This typically requires working closely with your local housing department, securing permits, and passing inspections.

Keep in mind:

- You’ll need licensed contractors for major work

- Some properties require tens of thousands in repairs

- Inspections may cause delays or add unexpected costs

- Not all repairs guarantee a higher sale price

This option may be suitable if the damage is minor and you wish to list your home on the open market, but it’s not always realistic for homeowners facing urgent financial or legal pressures.

Sell to a Real Estate Investor

Real estate investors are often willing to buy condemned houses in any condition. They’re familiar with local regulations and understand how to handle complex title issues, code violations, or back taxes.

Why investors are a strong option:

- They buy with cash and close fast.

- They know how to work with city officials.

- Many investors work with professionals who assist with paperwork related to the sale, helping streamline the process for sellers.

If you want to sell your condemned house without managing repairs or legal red tape, an experienced investor can offer a stress-free solution that lets you move on quickly.

What to Expect When Selling a Condemned Property

Selling a condemned house isn’t impossible, but it does come with a few extra steps. Knowing what to expect ahead of time can help you avoid surprises and make smarter decisions. Whether you plan to sell as-is or make repairs, here are key factors to keep in mind:

You Still Have Legal Obligations

As the property owner, you may still be responsible for maintaining certain standards required by your local government. It’s important to check with local authorities about any active notices or requirements.

Before you sell, check for:

- Open code violations or citations

- Unpaid property taxes or liens

- Court-ordered repair deadlines

Many buyers (especially cash buyers or investors) are prepared to deal with these issues, but they’ll want to know about them up front.

Disclose All Known Issues

Transparency matters, and many states require sellers to disclose known property defects, especially those that impact health or safety. It’s best to consult a local professional to understand what disclosures may apply.

That includes:

- Fire or flood damage

- Structural weaknesses

- Mold, asbestos, or lead paint

- Pest infestations

- Environmental hazards

Disclosing these issues doesn’t stop you from selling, it just protects you from future liability and builds trust with the buyer. Most experienced buyers expect these kinds of disclosures when dealing with condemned homes.

Time, Costs, and Delays to Prepare For

Selling a condemned home can take longer than a standard sale if you’re not working with the right buyer. Title issues, legal notices, or city inspections may add extra time and cost to the process.

Here’s what to prepare for:

- Potential title searches to uncover liens or unpaid taxes

- Possible permit fees or clearance documents

- Delays if the city requires repairs before transfer

The fastest way to avoid these setbacks is to sell to a buyer who understands the complexities of condemned properties. They’ll often handle the legwork and absorb the risk, saving you time and stress.

Why Cash Home Buyers Are a Smart Option

If your house is condemned, cash buyers offer one of the most practical ways to sell. Unlike traditional buyers, they aren’t scared off by repairs, city notices, or code violations. They’re used to working with distressed properties, and they’re prepared to move quickly.

Here’s why more homeowners turn to cash home buyers when dealing with condemned homes:

No Repairs, No Showings, No Commissions

Cash buyers purchase homes exactly as they are. That means:

- No fixing structural issues or clearing debris

- No open houses or walkthroughs

- No agent fees or closing costs

You won’t need to invest another dollar in the property. Cash home buyers take care of the details, so you can focus on moving forward.

Close on Your Timeline, Even in 7 Days

Selling through a real estate agent could take months. But cash buyers work on your schedule. In many cases, you can close in as little as 7 days, or select a later date if you require additional time.

Whether you’re trying to avoid city fines, settle an estate, or stop a foreclosure, cash buyers give you the flexibility to sell fast and leave when you’re ready.

Transparent Offers Based on Actual Condition

Cash buyers evaluate your home based on its current state, not on what it “could be” with repairs. There are no inflated promises or financing fall-through risk. You get a straightforward, no-obligation offer based on local market conditions and the property’s real condition.

The result? A stress-free process where you know exactly what to expect, with no hidden fees or last-minute changes.

How to Sell a Condemned House in 3 Simple Steps

At 48Acquisitions, we make it easy to sell a condemned home, no repairs, no delays, no surprises. Whether the house has code violations, significant damage, or a city notice, our process is designed to alleviate the stress and provide you with a fair offer quickly.

Here’s how it works:

Step 1 – Tell Us About the Property

Please provide us with some basic information about the house. You can fill out a quick form or call us directly. We’ll ask for:

- The property address

- Any known issues or notices

- Your ideal timeline

You don’t need to dig up records or prepare anything special. We’ve helped homeowners in all kinds of situations, and we’ll guide you through every step.

Step 2 – Get Your No-Obligation Cash Offer

Within 24 to 48 hours, you’ll receive a fair cash offer based on your property’s condition and location. There are no fees, no pressure, and zero obligations to accept.

We utilize local market data and our expertise with condemned homes to ensure your offer is both competitive and realistic.

Step 3 – Choose Your Closing Date and Get Paid

If you accept the offer, you’re in control of the next step. Select a closing date that suits you, as soon as 7 days from now, or later if you require additional time.

We handle the paperwork, pay any associated costs, and make the process as smooth as possible. On closing day, you’ll receive your payment in full.

It is that simple. No listings, no cleanups, no waiting, just a direct, respectful way to sell your condemned house.

Situations Where We Can Help

Selling a condemned house comes with unique challenges, but you’re not alone. At 48Acquisitions, we specialize in helping homeowners who feel stuck with properties no one else wants to touch. Whether your situation involves damage, legal issues, or inherited real estate, we offer a fast, respectful way to sell.

Here are the most common situations where we can help:

Health Department Violations

If your house has been condemned due to mold, biohazards, sewage backups, or unsanitary living conditions, the health department may have posted a notice or issued citations. These violations often feel overwhelming and expensive to correct.

We buy houses with active health department violations, no repairs, no cleanup needed. We work directly with you and the local authorities to simplify the process and help you move on quickly.

Fire or Storm Damage

Severe fire or storm damage can leave a home structurally compromised, uninhabitable, and condemned by the city. Insurance rarely covers every repair, and rebuilding can take months or more.

If you’re stuck with a damaged property that’s unsafe to live in, we’ll make a fair cash offer based on the home’s current condition. You don’t need to wait on repairs, contractors, or inspections, and we’re ready to buy as-is.

Inherited Condemned Property

Inheriting a property should feel like a blessing, but when that home is condemned, it can quickly become a burden. You may be dealing with probate, back taxes, or expensive repairs, in addition to everything else.

We’ve helped many sellers in your shoes. We’ll buy inherited condemned houses regardless of their condition or location. Our team handles the paperwork, simplifies the process, and gives you a stress-free way to sell and move forward.

Foreclosure or Vacant for Too Long

Houses left vacant often fall into disrepair, leading to vandalism, code violations, and condemnation. If your property is headed for foreclosure or is already in default, time is of the essence.

We specialize in buying condemned homes fast, even if they’re behind on payments or have liens. We’ll work within your timeline, help prevent further penalties, and offer a way out without incurring additional debt or stress.

FAQs About Selling Condemned Houses

If you’re dealing with a condemned home, it’s normal to have questions. Below are some of the most common concerns we hear from homeowners, along with clear answers to help you make confident decisions.

Can I sell my condemned home if I still have a mortgage?

Yes, you can sell a condemned house even if it still has an outstanding mortgage. Many homeowners in this situation choose to sell quickly to avoid further financial strain.

When you sell to a cash buyer like 48Acquisitions, part of the proceeds from the sale will go directly to paying off your mortgage. We’ll work with your lender and title company to make sure everything is handled correctly. Any remaining equity after the loan is paid off will be yours.

If the offer doesn’t cover your mortgage balance, you may still have options to explore, such as lender negotiations or short sales. In such cases, we recommend working with a real estate attorney or financial advisor.

What if the house is occupied?

If a condemned house is currently occupied by tenants, squatters, or even family members, you still have options. In many cases, we can purchase the property as-is and assume the responsibility of resolving occupancy issues.

We’ll evaluate the situation carefully and handle it with care and professionalism. Whether you’re concerned about eviction laws, tenant rights, or safety concerns, our team has experience with these scenarios and can guide you through the following steps without pressure.

What happens if I just walk away?

If the offer doesn’t cover your mortgage balance, you may still have options to explore, such as lender negotiations or short sales. In such cases, we recommend working with a real estate attorney or financial advisor.

If you abandon the home, you could face:

- Fines or penalties from the city

- Legal action for code violations

- Tax liens or foreclosure

- A hit to your credit score

Instead of walking away, consider a no-obligation cash offer. We can take over the property, resolve outstanding issues, and help you avoid long-term financial damage. You don’t have to stay stuck, but walking away shouldn’t be your first option.