Losing a parent is never easy, and dealing with their house afterward can feel overwhelming. If you’re wondering whether you can sell the home without going through probate, you’re not alone. The answer depends on a few key factors like how the home was owned and whether there’s a legal path that allows you to avoid the probate process.

This guide will walk you through when probate may be required, what your options are, and how to sell an inherited house smoothly, even if you’re facing legal uncertainty. We’ll break it down step-by-step so you can feel confident about your next move.

What Happens to a House When a Parent Passes Away?

When a parent passes away, their home typically becomes part of their estate and cannot be sold until legal ownership is clarified. What happens next depends on how the property was titled and whether they left a will or estate plan.

If the house was owned solely by your parent and no estate planning tools were in place, the property may go through probate. This court-supervised process ensures debts are paid and ownership is legally transferred to heirs. But if the home was jointly owned, such as with a spouse or through a trust, it may automatically transfer without probate.

Before doing anything, it’s important to check the title and confirm who legally owns the property. Trying to sell the house before you have that authority can create problems later. If you’re not sure where to start, a real estate attorney can help you determine whether the property can be sold or if probate is required.

Do You Always Need Probate to Sell an Inherited House?

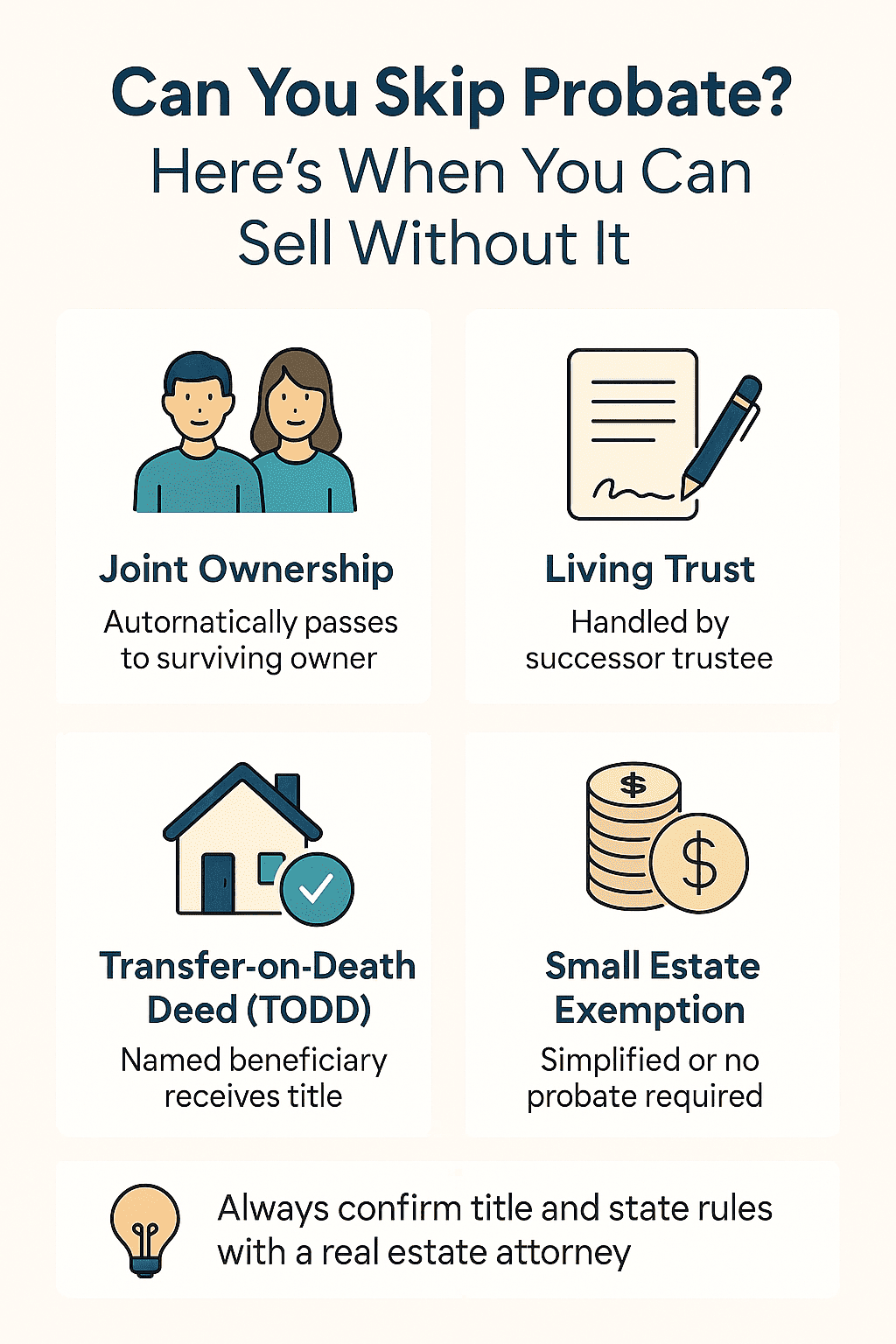

No, you don’t always need probate to sell an inherited house, but it depends on how the property was titled and what estate planning tools were in place. If your parent used methods like a living trust, transfer-on-death deed, or joint tenancy, you may be able to transfer or sell the property without going through probate.

Common probate exemptions include:

- Joint tenancy with right of survivorship: The surviving co-owner automatically inherits the home.

- Transfer-on-death deed (TODD): This document names a beneficiary who receives the property without court involvement.

- Living trust: If the home was placed in a trust, the successor trustee can manage or sell the property as outlined.

However, if your parent was the sole owner and none of these tools were in place, the property likely needs to go through probate before it can be legally sold. This ensures the title is clear and any debts tied to the estate are properly handled.

Understanding whether probate applies early on will help you avoid delays and potential legal trouble when you’re ready to sell.

Common Situations Where Probate May Not Be Required

Probate may not be necessary if your deceased parent took steps to simplify how their home transfers after death. These situations allow the property to bypass probate entirely or use a simplified version of it.

Here are the most common scenarios where probate might not be needed:

- Joint Ownership: If the house was jointly owned with right of survivorship, it automatically goes to the surviving owner.

- Living Trust: Properties placed in a revocable living trust can be managed or sold by the successor trustee without probate.

- Transfer-on-Death Deed (TODD): Some states allow you to name a beneficiary who inherits the house without going to court.

- Small Estate Exemption: If the total estate value is below your state’s small estate threshold, you may qualify for a simplified probate process or skip it altogether.

If any of these apply to your situation, you may be able to sell the property more quickly. Always confirm ownership and title status before listing the home, and consult a legal professional to ensure you’re following your state’s rules.

What Probate Is, and Why It Matters

Probate is the legal process used to verify a will, pay off debts, and distribute a deceased person’s assets, including their house. If the home was owned solely by your parent and no alternative legal arrangements were made, probate is often required before you can sell the property.

The court appoints someone (usually named in the will) as the executor. This person is responsible for gathering assets, settling debts, and distributing what’s left to the heirs. Until probate is completed and the executor is given authority, the property can’t be legally sold.

Probate exists to protect everyone involved, including heirs, creditors, and buyers, but it can be time-consuming and complicated. That’s why many people look for ways to avoid it, especially when they need to sell a home quickly.

Understanding probate helps you decide what steps you’ll need to take before selling, and whether there’s a way to simplify the process.

Legal Alternatives to Probate for Selling a House

You can sell your deceased parent’s house without probate if the property qualifies for certain legal alternatives. These methods are designed to transfer ownership directly to a beneficiary or co-owner, avoiding the delays and costs of probate court.

The key is how the property was titled before your parent passed. If legal arrangements were made in advance, the home may already have a clear path for transfer.

Let’s take a closer look at the most common probate alternatives that can allow for a faster, simpler sale.

Transfer on Death Deeds (TODDs)

A Transfer on Death Deed (TODD) allows a homeowner to name a beneficiary who will automatically receive the property upon their death, no probate required. This legal tool is available in many states and works much like naming a beneficiary on a life insurance policy.

If your deceased parent recorded a TODD before passing, you can claim the property by filing a death certificate and an affidavit with the county. Once that’s done, you become the legal owner and can sell the house without going through probate.

TODDs are simple, low-cost, and effective, especially for families looking to avoid court delays. However, not all states allow TODDs, so you’ll need to confirm with your local real estate attorney or title office.

Joint Tenancy with Right of Survivorship

If your parent owned the home with someone else as joint tenants with right of survivorship, the surviving co-owner automatically becomes the sole owner when one person passes away. No probate is needed to transfer the title.

This is common among spouses, but it can also apply to other relatives or partners if the deed was set up this way. All that’s typically required is filing a certified death certificate with the county recorder’s office to update the title.

Once the surviving owner is officially recognized, they can sell the property without going through probate. This setup is one of the easiest ways to ensure a smooth transition, especially when a quick sale is needed.

Revocable Living Trusts and Real Estate

A revocable living trust is another way to avoid probate when selling a deceased parent’s house. If your parent placed their home into a trust before passing, the person named as the successor trustee can take over management of the property, including selling it, without court involvement.

The trust document outlines who inherits the property and under what conditions. Once your parent passes, the trustee has the authority to transfer or sell the home, pay off debts, and distribute proceeds according to the trust’s instructions.

Because the property never technically goes through the probate estate, the sale can move forward faster and with fewer legal hurdles. This approach is especially useful for families looking to avoid delays and protect privacy.

Selling an Inherited House Without Probate: Step-by-Step

If probate isn’t required, you can sell your inherited house by following a few straightforward steps. The key is confirming legal ownership and making sure the title is clean before moving forward.

Confirm Legal Ownership and Title Access

Before you can sell the house, you must be listed as the legal owner on the property title. Even if you’ve inherited the home, the title must be officially transferred into your name, or the name of the trust or co-owner, before listing it.

To do this, you’ll likely need to file a certified death certificate with your local county recorder’s office, along with any supporting legal documents like a TODD, trust paperwork, or joint tenancy affidavit.

Once title transfer is complete, you’ll have full authority to move forward with the sale. Skipping this step can cause serious delays during escrow or result in title issues that prevent closing.

Get Agreement from All Heirs (if applicable)

If multiple heirs inherited the property, you’ll need everyone’s written agreement before selling the house. This often applies when a parent passes away without a trust or transfer deed, and the home is left to several children or family members.

All heirs must sign off on the sale and any related paperwork. If even one person disagrees or delays, the process can stall. It’s a good idea to have a clear conversation upfront, and possibly involve a real estate attorney, to avoid misunderstandings.

Once everyone is on the same page, you can move forward with confidence knowing the sale won’t hit legal roadblocks from within the family.

Partner with a Real Estate Attorney or Cash Buyer

When selling an inherited house, especially without probate, working with experienced professionals can make all the difference. A real estate attorney can help verify title status, draft the right documents, and ensure you’re following your state’s legal requirements.

If you want to avoid delays, a reputable cash home buyer can simplify the process even more. They often buy properties as-is, cover closing costs, and move quickly, so you don’t have to worry about repairs, showings, or financing falling through.

Whether you choose a legal advisor or a trusted cash buyer, having someone who understands probate and inheritance sales can reduce stress and help you close smoothly.

Can I Sell the House As-Is Without Probate?

Yes, you can sell the house as-is without probate, as long as you’re the legal owner and the property title doesn’t require court approval. Selling as-is means you don’t need to make repairs or updates before listing, which is ideal for inherited homes that may need work.

If you’ve inherited the house through a trust, TOD deed, or joint tenancy, and the title has been properly transferred, you’re free to sell it in its current condition. Many cash buyers specifically look for these types of properties and are prepared to handle repairs themselves.

Selling as-is helps you avoid the cost and hassle of renovations, and it often shortens the timeline from decision to closing. Just make sure you disclose known issues to buyers and confirm you have the legal right to sell before signing a contract.

Why Cash Home Buyers Simplify the Process

Cash home buyers make it easier to sell an inherited house, especially if you’re trying to avoid probate, repairs, or delays. Because they don’t rely on mortgage approvals, cash buyers can close quickly, often in just days.

They typically buy properties as-is, which means you won’t need to clean, stage, or fix anything. This is especially helpful if the house has been vacant or needs repairs you’re not ready to handle.

Cash buyers also understand probate-related situations and often work with families dealing with estate issues. That means fewer roadblocks and more peace of mind during a difficult time.

Benefits of Selling As-Is for Inherited Homes

Selling an inherited home as-is offers several advantages, especially if you want to move quickly or avoid spending money on repairs. You get to skip the traditional real estate prep, no contractors, no cleanouts, and no waiting for buyers to secure financing.

Here’s why selling as-is can be a smart choice:

- Speed: Cash buyers can close in as little as a few days.

- Simplicity: You avoid inspections, repairs, and negotiations over minor issues.

- Cost savings: No out-of-pocket expenses for fixing or staging the house.

- Less stress: You focus on moving forward instead of managing a renovation project.

For many families, the ease and speed of an as-is sale outweigh the potential for a slightly higher price through traditional channels, especially if probate is avoided.

What If Probate Is Still Required? Your Options

If probate is required, you can still sell your deceased parent’s house, but the process will take more time and involve court approval. The executor or administrator of the estate must be legally appointed before the property can be sold, and the court may need to sign off on the transaction.

While it’s not as quick as selling without probate, there are ways to keep the process moving forward. Working with professionals who specialize in probate sales can help reduce delays and avoid common mistakes.

Let’s explore what your options are if probate is unavoidable.

Work With Professionals Who Handle Probate Sales

Selling a house through probate is more complex, but the right professionals can guide you through it step by step. A probate attorney can help you file the correct paperwork, meet court deadlines, and avoid legal missteps.

Real estate agents experienced in probate sales understand how to price, market, and sell a home that’s tied up in the court process. They’ll coordinate with your attorney and title company to make sure everything moves forward smoothly.

If time is critical, you can also work with a cash buyer familiar with probate. Some buyers specialize in purchasing homes from estates, and they know how to navigate the process while keeping things simple for you.

Ways to Speed Up the Probate Timeline

While probate can be a lengthy process, there are steps you can take to help move things along. The sooner you act, the sooner you can position the home for sale.

Here’s how to speed up probate when possible:

- File promptly: Submit the will and death certificate to the court as soon as possible.

- Stay organized: Gather important documents early, like the deed, mortgage info, and any existing estate plans.

- Work with experienced professionals: A probate attorney who knows your state laws can prevent delays and ensure the court process runs efficiently.

- Communicate with heirs: Resolve any family disagreements early to avoid court disputes that can stall the sale.

While you can’t skip required steps, being proactive can shave weeks, or even months, off the timeline.

Final Thoughts: Making a Stress-Free Sale Possible

Selling a deceased parent’s house without probate is possible, but only if the right legal conditions are met. Whether the home was placed in a trust, owned jointly, or transferred through a TOD deed, you may be able to skip probate and move forward with the sale faster than you think.

Even if probate is required, you’re not alone. With the right support from legal professionals and experienced home buyers, the process doesn’t have to be overwhelming. At 48Acquisitions, we specialize in helping families navigate complex property situations with care, speed, and clarity.

You’re in control of the timeline, and we’re here to help every step of the way.

Frequently Asked Questions About Selling Without Probate

If you’re thinking about selling a deceased parent’s house without probate, you probably have questions. Below are answers to the most common questions homeowners ask when navigating this emotional and legal process.

Can siblings sell a house without probate?

Siblings can sell a house without probate only if they are the legal owners of the property. This usually happens when the home was transferred through a trust, joint tenancy, or a valid transfer-on-death deed. If none of these are in place and your parent was the sole owner, probate is typically required before any sibling can legally sell the property.

To move forward, the title must clearly list the siblings as the owners. Without that legal ownership, the court must first authorize the transfer through the probate process.

Do I need a will to avoid probate?

No, having a will does not avoid probate, in fact, most wills go through probate court. A will simply directs how your parent wanted their assets distributed, but it still needs to be validated by the court before property can be transferred.

To avoid probate, your parent would have needed to use tools like a living trust, joint ownership, or a transfer-on-death deed. These methods bypass the court process entirely and allow the property to pass directly to beneficiaries.

So while a will is helpful, it alone doesn’t eliminate the need for probate.

How do I prove I can sell my parents’ house?

To prove you can legally sell your parents’ house, your name must be on the property title. If the home was transferred to you through a trust, TOD deed, or joint tenancy, you’ll typically just need to file the death certificate and supporting documents with the county.

If the property is in probate, you’ll need a court-issued document, like “Letters Testamentary” or “Letters of Administration”, naming you as the executor or administrator. This document gives you the legal authority to manage and sell the estate’s assets.

Without this proof of ownership or legal authority, title companies won’t allow the sale to proceed.