Yes, and here’s how to do it without the stress.

If you’re worried that a lien on your property means you’re stuck, you’re not alone. Many homeowners assume they can’t move forward until the debt is cleared. The truth is, you can sell a house with a lien, and in many cases, you have more options than you think.

Liens can feel overwhelming, especially when you’re dealing with other challenges like divorce, foreclosure, or inheritance. But selling your house is still possible. In fact, homeowners sell properties with liens every day by working with experienced buyers who understand how to resolve these issues.

This guide will walk you through what a lien means, how it affects your sale, and what steps to take if you’re ready to move on. Whether you’re facing a tax lien, contractor lien, or something else, there’s a path forward, and we’re here to help make it clear and stress-free.

What Is a Lien and How Does It Affect Homeowners?

A lien is a legal claim placed on your property because of an unpaid debt. It gives the creditor a right to a portion of the sale proceeds if the home is sold. For homeowners, this means you may not have full control over your property until the lien is resolved.

Liens are commonly placed by tax authorities, contractors, lenders, or even courts. They don’t prevent you from living in or maintaining the home, but they can complicate the selling process if not handled properly.

While it might sound intimidating, having a lien doesn’t mean you’re out of options. Understanding the type of lien on your home is the first step toward resolving it and moving forward with your sale.

Let’s look more closely at how liens show up, and why they’re more common than many homeowners realize.

Understanding property liens in plain terms

A lien is like a red flag attached to your property title. It signals that someone, a government agency, contractor, or creditor, has a financial claim against your home. Think of it as a legal “IOU” recorded in public records.

Liens don’t usually happen overnight. They’re often the result of unpaid bills, unresolved disputes, or back taxes. Until the lien is settled, it stays attached to your property. If you try to sell the home, that lien must be addressed before a clean title can be transferred to the buyer.

Liens are not always a dealbreaker. With the right steps, you can sell your house, settle the lien at closing, and move on with peace of mind.

Common reasons liens are placed on homes

Liens can come from many sources, but most fall into these common categories:

- Unpaid Property Taxes

- Tax authorities place liens if local or state property taxes go unpaid.

- Mortgage or Loan Defaults

- Your lender has a lien on your home until the loan is fully paid off.

- Mechanic’s or Contractor Liens

- If a contractor isn’t paid for work on your home, they can file a lien, even if you disputed the charge.

- Judgment Liens

- Courts may place a lien if you lose a lawsuit and don’t pay the judgment.

- HOA Liens

- Homeowners’ associations can file liens for unpaid dues or violations.

- IRS or State Tax Liens

- Federal or state tax agencies can secure payment by placing liens on your home.

Understanding the type of lien you’re facing will help you determine the best path forward when it’s time to sell.

Can You Sell a House With a Lien?

Yes, you can sell a house with a lien, but the lien must be addressed before closing. Most liens won’t block a sale outright, but they do require resolution. That typically means paying off the debt or negotiating with the lienholder so the title can transfer cleanly to the buyer.

This process may feel complicated, especially if you’re also dealing with other challenges like foreclosure or divorce. But many homeowners successfully sell properties with liens every year. The key is understanding your legal options and working with experienced professionals who know how to navigate title issues.

Let’s break down how it works and what you, and your buyer, should expect.

The truth about your legal options

In many cases, a home with a lien can still be sold, as long as the lien is addressed at closing. Common strategies include paying off the lien in full, settling with the creditor, or using the sale proceeds to satisfy the debt. An experienced title company or real estate attorney can help clarify which options apply in your situation.. Here are your main options:

- Pay off the lien before listing – Ideal if the amount is small and you have the funds.

- Use sale proceeds to pay the lien – This is the most common method. The lien amount is deducted directly from the proceeds at closing.

- Negotiate with the lienholder – Sometimes liens can be settled for less than the full amount.

- Sell to a cash home buyer – Many investors are experienced in handling properties with liens and can help you avoid traditional delays.

Each of these paths depends on the type and size of the lien, but all are valid ways to move forward without losing control of your sale.

What buyers need to know before purchasing a property with a lien

Buyers need to be informed that a lien exists and how it will be resolved. If you’re transparent about the situation and have a clear plan to address the lien, most serious buyers won’t walk away.

That said, some buyers, especially those using financing, may hesitate or require delays. This is why cash buyers are often the best solution. They’re used to dealing with liens, don’t rely on lender approval, and can move forward quickly as long as title resolution is in motion.

The key takeaway? Clear communication and a clean title plan keep buyers confident and the sale on track.

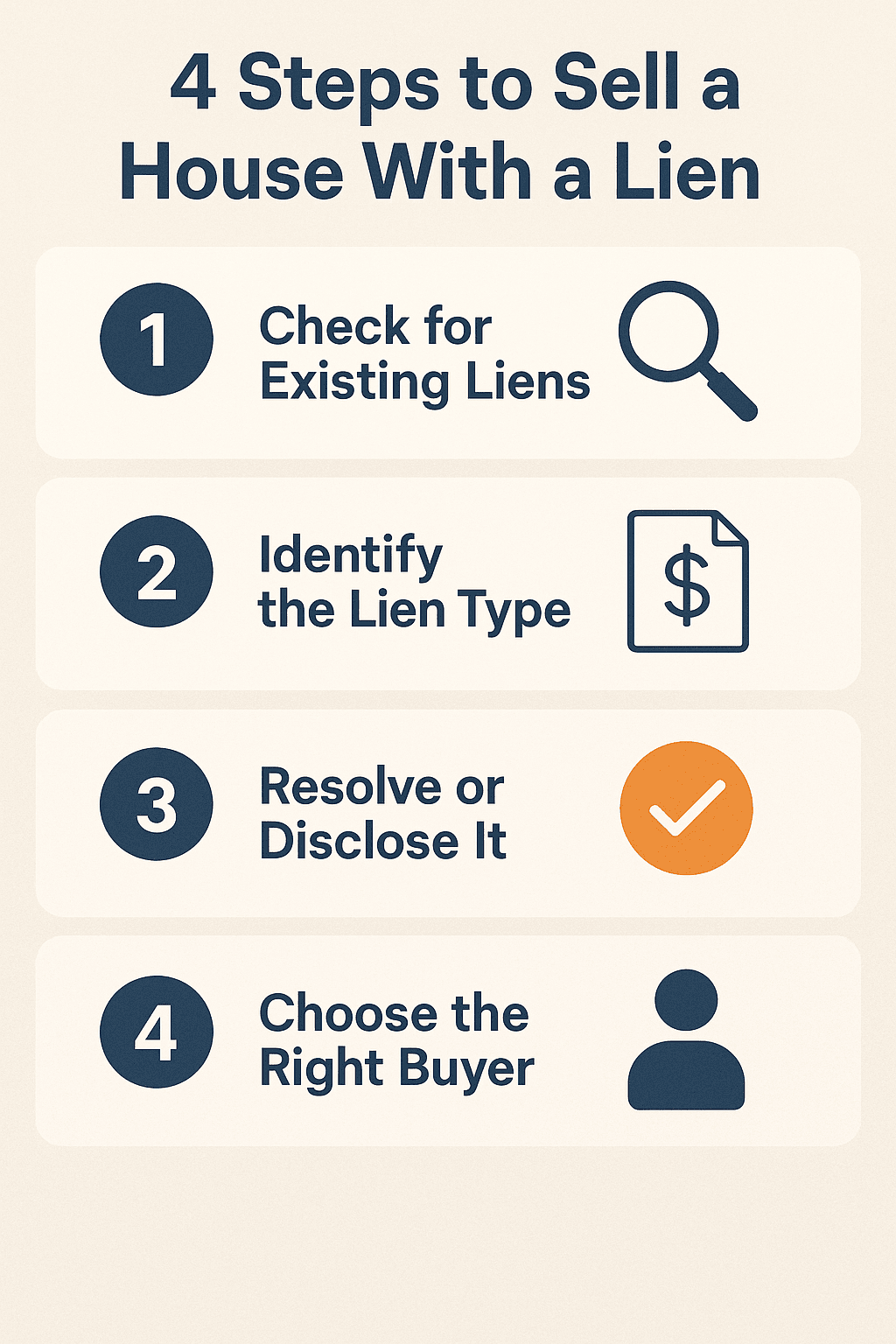

How to Sell a House With a Lien: Step-by-Step Guide

Selling a house with a lien takes a few extra steps, but it’s entirely doable. Whether the lien is big or small, knowing what to do next can save you time, money, and stress. Here’s a clear path to follow.

Step 1: Find out if a lien exists

You might already know about a lien, especially if it’s tied to taxes or legal judgments. But in some cases, homeowners are surprised to learn about a lien during the title search.

To check for liens:

- Request a preliminary title report through a title company.

- Ask your local county recorder’s office for property records.

- Look for notices from tax agencies, HOAs, or contractors.

Knowing what kind of lien you’re dealing with helps you prepare the right solution.

Step 2: Understand what type of lien it is

Not all liens are created equal. Some are easier to resolve than others. Here’s how different types impact the sale:

- Tax liens may require full payment or negotiation with the IRS or local agency.

- Mechanic’s liens can often be disputed if the contractor didn’t follow proper filing rules.

- Judgment liens may be settled for less or paid from sale proceeds.

- Mortgage liens are common and usually paid off through the closing process.

Identifying the lien type helps determine your negotiation strategy and timeline.

Step 3: Resolve, settle, or disclose the lien

Once you’ve confirmed the lien, your next step is to:

- Pay it off in full using savings or loan proceeds

- Settle for a lower amount if the creditor is open to negotiation

- Disclose it to the buyer with documentation on how it will be cleared at closing

In most cases, liens are paid out of your sale proceeds at closing. Your title agent will handle the transaction, ensuring the lien is satisfied and removed.

Step 4: Work with a cash home buyer if needed

If the lien is large or you’re in a time-sensitive situation, a cash home buyer can simplify the process. Companies like 48Acquisitions are used to working with liens and title issues. They:

- Buy your house as-is

- Coordinate directly with lienholders

- Handle paperwork and closing costs

- Ensure a fast, smooth transaction

If traditional buyers back out or delay, cash buyers offer a trusted alternative to sell your home without added pressure.

The Benefits of Selling to a Cash Home Buyer When a Lien Exists

Selling your house to a cash buyer is often the simplest way to deal with a lien. If you’re facing foreclosure, legal deadlines, or just want to avoid the stress of repairs and paperwork, cash buyers offer a clear path forward.

Unlike traditional buyers, cash home buyers understand how liens work and can help you sell quickly, even when your property has title issues. Here’s how they make the process easier and faster:

Avoid delays and complications

Traditional home sales often fall apart when a lien is discovered during the title search. Lenders usually won’t approve a mortgage unless the title is clean, which can delay or kill the sale.

Cash home buyers eliminate these delays. They don’t rely on lender approval, so the process moves faster.

Why this matters:

- No appraisals or mortgage underwriting

- No waiting on buyer financing

- Faster closings, often in 7 days or less

Skip repairs, inspections, and drawn-out negotiations

One of the biggest advantages of working with a cash buyer is you can sell your house exactly as it is, even with a lien. There’s no need to fix anything or worry about how the property looks to traditional buyers.

Here’s what you avoid:

- Costly repairs or renovations

- Home inspections that uncover issues

- Endless back-and-forth on price or contingencies

Cash buyers like 48Acquisitions purchase homes in as-is condition. They factor in the lien and any needed updates upfront, so you get a fair offer without the usual real estate headaches.

Bottom line: If you’re overwhelmed by repairs or don’t have the funds to fix the property before selling, this option saves you time and energy.

What Happens to the Lien at Closing?

At closing, the lien is usually paid off using proceeds from the home sale. This ensures the title is cleared so the buyer receives full ownership of the property. It’s a standard part of the process when selling a house with a lien.

Your closing agent or title company plays a key role here. They’ll calculate the exact payoff amount owed to the lienholder, whether it’s the IRS, a contractor, or a lender. That amount is then deducted directly from the sale price before you receive your remaining funds. Once the lien is paid, the title is updated and the lien is removed from public record.

If the sale price isn’t enough to cover the lien, you may need to bring funds to closing or work out a settlement with the lienholder. In some cases, especially with tax or judgment liens, creditors are willing to negotiate a reduced payoff to help the sale move forward.

Cash buyers are often experienced in navigating this step and will work directly with the title company to make sure everything is handled correctly. For you as the seller, this means less stress and no legal surprises after closing. As long as the lien is addressed during the transaction, you can walk away with peace of mind, and often with cash in hand.

How liens are handled during a cash sale

Cash sales are often the smoothest way to handle properties with liens. Cash buyers usually work with title companies that specialize in resolving liens quickly. The process doesn’t involve lender approvals, so there’s more flexibility in how and when the lien is paid. The buyer knows exactly what they’re purchasing, and you as the seller can rely on a clear plan to close without delays. Cash sales remove a lot of the pressure, especially if you’re trying to avoid foreclosure or move on fast.

Can you walk away with money after the lien is paid off?

Yes, you can still walk away with money after the lien is paid, if the sale price is higher than what you owe. Once the lien is paid and any closing costs are settled, the remaining balance goes to you. This is especially true in cases where there’s significant equity in the home. Even if the lien takes up a portion of the proceeds, many homeowners still leave the sale with enough cash to make their next move comfortably.

Sell With Confidence – Even With a Lien

A lien doesn’t have to stop you from selling your house, and it doesn’t have to add stress to your life. Whether you’re facing a tax issue, a legal judgment, or unpaid contractor fees, there’s a clear and professional way forward.

At 48Acquisitions, we specialize in buying homes with title complications like liens, probate issues, or foreclosure risks. We understand that life happens, and we’re here to make selling your house feel simple, safe, and transparent.

With the right buyer and the right process, you can sell your home, resolve the lien, and move on with cash in hand, without dealing with agents, fees, or unnecessary delays.

Why 48Acquisitions is trusted by homeowners in tough situations

When selling a house with a lien, trust matters. Homeowners across Arizona and beyond turn to 48Acquisitions because we don’t just buy houses, we solve problems. Our team understands how overwhelming liens can be, especially when you’re dealing with divorce, foreclosure, relocation, or an inherited property.

What sets us apart is how we treat you throughout the process. We listen first. Then we work quickly to deliver a fair, no-obligation cash offer that reflects your home’s value, even with a lien in place. There’s no judgment, no pressure, and no guesswork. Just experienced support and a proven process that helps you move forward with confidence.

From title searches to closing coordination, we handle the tough parts so you don’t have to. That’s why so many homeowners choose 48Acquisitions when selling gets complicated.

No repairs. No fees. Just a clear path forward.

Selling your house with a lien doesn’t need to involve fixing up the property, hiring agents, or paying closing costs. With 48Acquisitions, you sell your house as-is. That means no cleaning, no repairs, and no unexpected fees.

We cover all closing costs, and there are no commissions or hidden charges. The offer you receive is exactly what you’ll get at closing. If you accept, we work around your schedule and close on your timeline, even in as little as seven days.

This is more than just a fast sale. It’s a way to move on from a stressful situation with clarity and peace of mind. If you’re ready to sell your house, even with a lien, we’re here to help you take the next step.

Frequently Asked Questions About Selling a House With a Lien

Homeowners often have concerns when selling a property with a lien, and for good reason. It’s a unique situation that requires clear answers. Here are some of the most common questions we hear, along with honest, helpful guidance.

Can a lien stop the sale?

Yes, a lien can delay or temporarily stop a home sale, but it doesn’t have to. The sale cannot officially close until the lien is addressed. That means the title must be clear before the buyer takes ownership. If the lien isn’t resolved, the buyer’s title insurance won’t be issued, and most closing agents won’t proceed. The good news is that many liens can be paid or settled during the closing process using the proceeds from the sale, making it possible to move forward without major delays.

What if I can’t afford to pay off the lien?

If you can’t afford to pay off the lien out of pocket, you’re not out of options. Many homeowners use the proceeds from the home sale to cover the lien at closing. The title company or closing attorney handles the payment directly, ensuring the lien is cleared before the buyer receives the deed.

In situations where the lien amount exceeds your home equity, you may be able to negotiate a settlement with the lienholder. Some creditors are open to accepting a lower amount if it allows the sale to close. Working with a cash buyer can also help, as they’re experienced in structuring deals that account for lien payoff while still getting you a fair price. The key is to communicate early, know your numbers, and lean on professionals who can guide the process.

Do liens ever go away on their own?

Liens don’t usually disappear on their own. Most remain attached to your property until they’re paid off or formally removed by the creditor. Some liens have expiration dates, but even then, the process isn’t automatic. You’ll typically need to request a release from the lienholder and file it with your local records office.

Ignoring a lien or waiting for it to expire could delay your ability to sell the property. Title companies will still flag any active or unresolved liens, and buyers will expect them to be cleared before closing. If you’re unsure about the status of a lien, a title search can help you get a clear picture and plan your next move with confidence.

Is selling with a lien legal in all states?

In most states, it is possible to sell a house with a lien, as long as the lien is addressed during the closing process. That said, state-specific laws may affect how different types of liens are handled, and it’s important to work with a title professional or legal advisor who understands local requirements. What’s consistent across the board is that the lien must be cleared before or during closing so the buyer receives a clean title. State laws may influence how quickly a lien can be enforced, what notice must be given, and how title companies handle specific types of claims.

In some areas, certain liens, like those from unpaid utilities or local governments, may require additional steps before the sale can proceed. That’s why it’s helpful to work with a local professional who understands the legal landscape in your state. Selling with a lien is possible, but knowing your state’s rules helps avoid last-minute surprises.

What if the lien is incorrect or disputed?

If you believe a lien on your property is incorrect or unfair, you have the right to dispute it. In many cases, errors happen due to outdated records, miscommunication with contractors, or billing issues. Start by contacting the lienholder and requesting written proof of the debt. If the lien was filed in error, they may agree to remove it voluntarily.

If the dispute can’t be resolved directly with the lienholder, you may wish to consult a real estate attorney to understand your legal options. Keep in mind that unresolved liens, disputed or not, can still delay your sale. Title companies require clear documentation that the lien has been satisfied, removed, or ruled invalid before closing. Acting early and gathering supporting documents can make the process smoother, even if the lien ends up being contested.