Home appraisals play a bigger role in your home sale than most homeowners realize. A number that comes in too low can delay your plans or derail them completely. And while some value factors are obvious, others might catch you off guard.

If you’re preparing to sell or refinance, understanding how your home will be evaluated can help you stay ahead. In this guide, we’ll walk through four unexpected issues that can lower your appraisal, plus what you can do about them.

Why Your Appraisal Matters More Than You Think

A home appraisal directly impacts how much your house is worth in the eyes of lenders, buyers, and investors. Whether you’re refinancing or selling, the appraised value can influence everything from how much money you can borrow to whether your deal moves forward at all.

What an appraiser actually evaluates

Appraisers look at the condition of your home, recent comparable sales, your neighborhood, and unique property features. They evaluate square footage, number of bedrooms and bathrooms, structural integrity, and recent upgrades, all while following strict guidelines to keep things objective.

How appraisal results impact your home sale or refinance

The appraised value determines how much a lender is willing to finance, which can directly affect a buyer’s ability to close. If the number comes in low, buyers might renegotiate or walk away. If you’re refinancing, a low appraisal can limit how much equity you can tap into or prevent you from securing better terms.

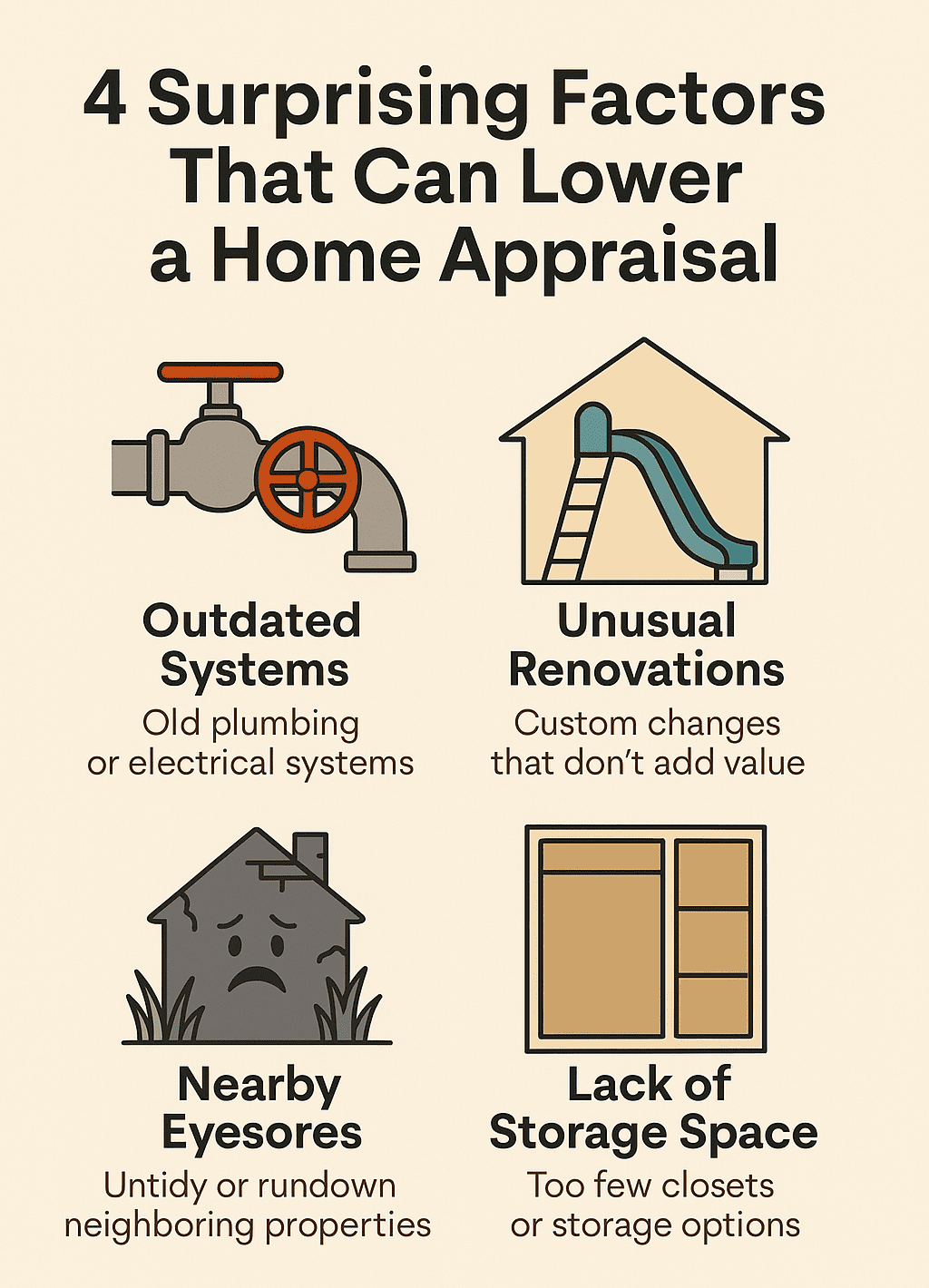

The Most Overlooked Issues That Lower Home Value

Not every factor that drags down an appraisal is obvious. Some of the most common appraisal surprises come from things homeowners overlook, or think don’t matter.

1. Outdated Systems and Aging Infrastructure

Even if everything still “works,” outdated plumbing, wiring, or HVAC systems can hurt your home’s appraised value. Appraisers consider the remaining useful life of major systems, and if yours are nearing the end, it can cost you in the valuation.

2. Unusual Renovations That Don’t Add Value

Custom changes that reflect your personal taste, like a converted garage gym or an oversized sunken tub, may not appeal to most buyers. Appraisers look for updates that increase utility or align with local demand. If your upgrades stray too far from what’s standard, they can work against you.

3. Nearby Eyesores or Problem Properties

Your neighbor’s neglected yard or a vacant, run-down home down the street can reduce your home’s appraised value. Appraisers take in the condition of the surrounding area, not just your property. If your home sits next to a visible problem, it can affect perceived marketability.

4. Lack of Functional Storage Space

Homes that lack closets, garages, or organized storage options often see lower appraisals. Buyers want functional space, and appraisers notice when it’s missing, even in otherwise updated homes.

Factors That May Surprise You But Won’t Fool an Appraiser

Some upgrades or home features might seem like selling points, but they don’t always impress an appraiser. These factors can surprise homeowners, especially when they don’t lead to the value boost you expected.

The “over-improved” home trap

Going above and beyond with upgrades doesn’t guarantee a higher appraisal. If your home far exceeds the quality or style of others in your neighborhood, the appraiser may not be able to justify a comparable value. Over-improving often leads to spending more than you’ll get back in value.

When size and layout work against you

Bigger isn’t always better. Appraisers evaluate usable living space and layout functionality, not just square footage. A home with lots of awkward or unusable space, like a huge foyer or a bedroom without a closet, might appraise lower than a smaller but more practical layout.

How landscaping can work for or against you

Curb appeal matters, but elaborate landscaping doesn’t always translate to higher value. Appraisers consider how well-maintained your yard is, not necessarily how much you spent. In some cases, high-maintenance landscaping can even be seen as a burden to future buyers.

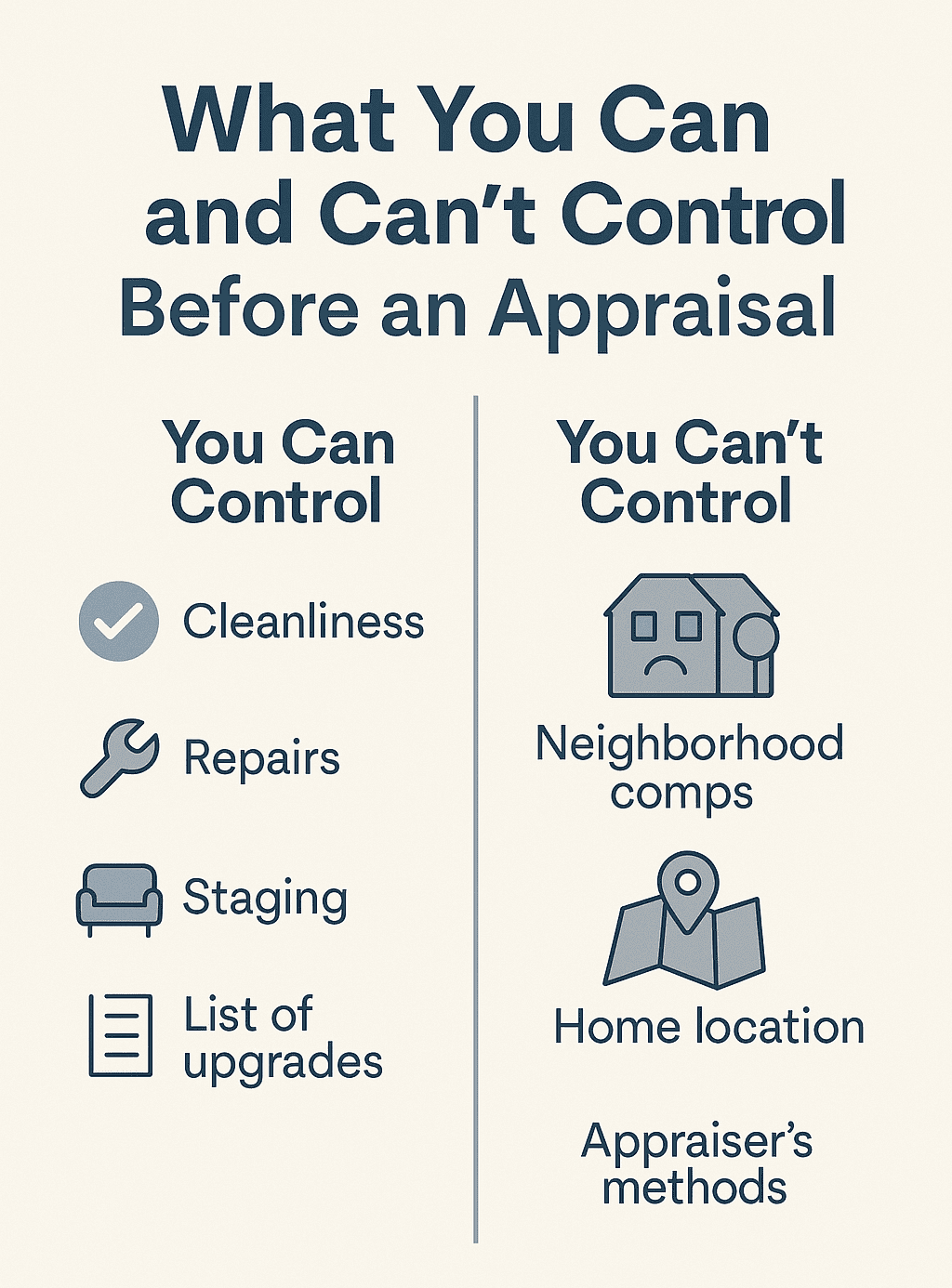

What You Can (And Can’t) Control Before an Appraisal

You can’t change your home’s location or the comparable sales in your neighborhood, but there are still steps you can take to protect your home’s value before the appraiser arrives.

Easy wins to improve perceived value

Tidy up your home, mow the lawn, fix minor repairs, and make sure everything is in working order. Clean, clutter-free spaces look more valuable. Small touches like new light bulbs, fresh caulk in the bathroom, or a working doorbell show that your home is cared for, and that matters.

Common mistakes homeowners make

Some sellers overdo it with last-minute upgrades that don’t move the needle. Others leave out key improvements when speaking with the appraiser. Always provide a written list of updates you’ve made, including dates and costs. Skipping this step means the appraiser may miss things that increase your value.

What appraisers typically exclude from their evaluation

Appraisers typically focus on a property’s physical structure and market-relevant features, not on personal items like decor or furniture. Their assessments emphasize functionality and overall condition, not furnishings or clutter. They also won’t give extra credit for things like custom curtains, mounted TVs, or luxury furniture. Their focus is on the physical structure, functionality, and market-relevant features of your home.

Worried About a Low Appraisal? Here’s What You Can Do

If your home appraises for less than expected, you’re not out of options. There are practical steps you can take to respond and still move forward with confidence.

Requesting a reconsideration

If you believe the appraisal was inaccurate, you can request a formal review. If you’re working with a lender, you can ask them about requesting a Reconsideration of Value (ROV).

Selling as-is with confidence

Sometimes, it’s not worth making upgrades or waiting on a reappraisal. Selling as-is to a cash home buyer can remove uncertainty and speed up your timeline. These buyers focus on the property’s potential and often make fair offers regardless of what the formal appraisal says.

When to consider a cash home buyer

If you’re facing a tight timeline, financial stress, or a deal falling through due to appraisal issues, a cash buyer can be a smart solution. You skip the lender approval process entirely, which means no appraiser, no delays, and no risk of a low value killing your deal.

FAQs: Home Appraisal Factors Explained

Does a messy house hurt the appraisal?

Not directly. Appraisers are trained to look past clutter and focus on the structure and condition of your home. That said, excessive mess can create a negative impression and may lead them to overlook or undervalue certain features.

Can landscaping affect my home value?

Yes, to a point. Well-maintained landscaping supports curb appeal, which can positively influence an appraisal. But over-the-top designs or high-maintenance yards usually won’t add value unless they’re common in your neighborhood.

What hurts a home appraisal the most?

Deferred maintenance, outdated systems, poor curb appeal, and unfavorable comps nearby are top culprits. Anything that reduces a home’s functionality, safety, or market appeal can bring the value down, even if the home feels “nice” overall.